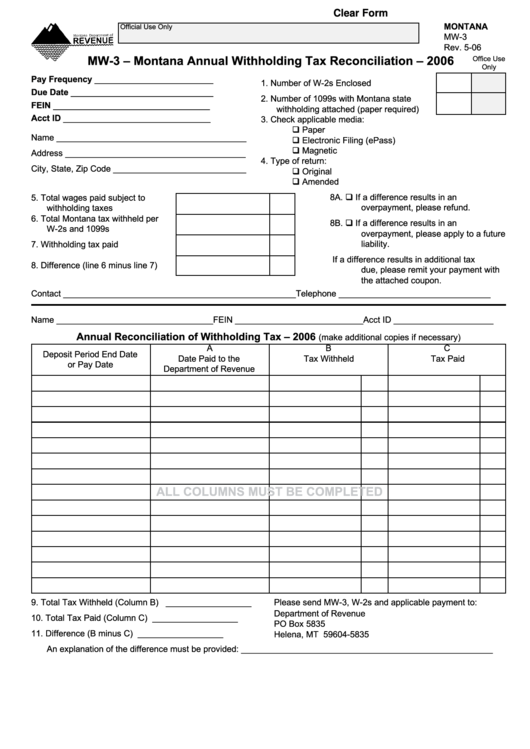

Clear Form

MONTANA

Official Use Only

MW-3

Rev. 5-06

MW-3 – Montana Annual Withholding Tax Reconciliation – 2006

Office Use

Only

Pay Frequency _________________________

1. Number of W-2s Enclosed .......................

Due Date ______________________________

2. Number of 1099s with Montana state

FEIN _________________________________

withholding attached (paper required) .....

Acct ID _______________________________

3. Check applicable media:

Paper

Name ________________________________________

Electronic Filing (ePass)

Magnetic

Address ______________________________________

4. Type of return:

City, State, Zip Code ____________________________

Original

Amended

5. Total wages paid subject to

8A. If a difference results in an

overpayment, please refund.

withholding taxes ........................

6. Total Montana tax withheld per

8B. If a difference results in an

W-2s and 1099s ..........................

overpayment, please apply to a future

liability.

7. Withholding tax paid ....................

If a difference results in additional tax

8. Difference (line 6 minus line 7)....

due, please remit your payment with

the attached coupon.

Contact _________________________________________________ Telephone ________________________________

Name _________________________________ FEIN ___________________________Acct ID _____________________

Annual Reconciliation of Withholding Tax – 2006

(make additional copies if necessary)

A

B

C

Deposit Period End Date

Date Paid to the

Tax Withheld

Tax Paid

or Pay Date

Department of Revenue

ALL COLUMNS MUST BE COMPLETED

9. Total Tax Withheld (Column B) __________________

Please send MW-3, W-2s and applicable payment to:

Department of Revenue

10. Total Tax Paid (Column C)

__________________

PO Box 5835

11. Difference (B minus C)

__________________

Helena, MT 59604-5835

An explanation of the difference must be provided: _____________________________________________________

1

1