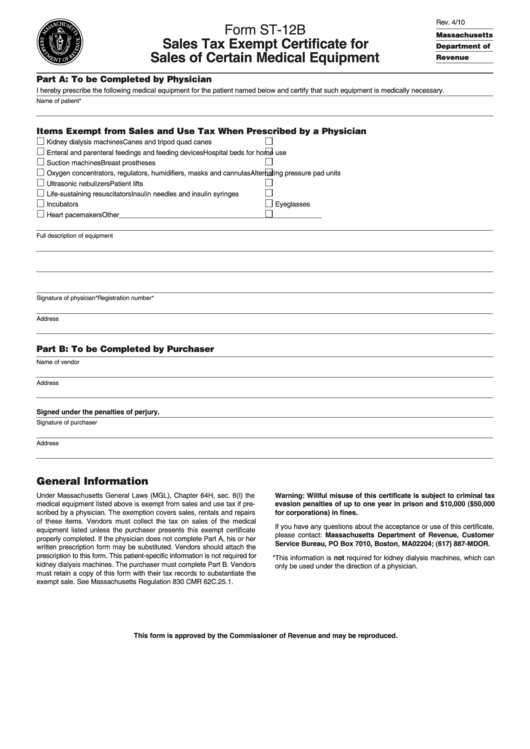

Form St-12b - Sales Tax Exempt Certificate For Sales Of Certain Medical Equipment

ADVERTISEMENT

Rev. 4/10

Form ST-12B

Massachusetts

Sales Tax Exempt Certificate for

Department of

Sales of Certain Medical Equipment

Revenue

Part A: To be Completed by Physician

I hereby prescribe the following medical equipment for the patient named below and certify that such equipment is medically necessary.

Name of patient*

Items Exempt from Sales and Use Tax When Prescribed by a Physician

Kidney dialysis machines

Canes and tripod quad canes

Enteral and parenteral feedings and feeding devices

Hospital beds for home use

Suction machines

Breast prostheses

Oxygen concentrators, regulators, humidifiers, masks and cannulas

Alternating pressure pad units

Ultrasonic nebulizers

Patient lifts

Life-sustaining resuscitators

Insulin needles and insulin syringes

Incubators

Eyeglasses

Heart pacemakers

Other_____________________________________________________

Full description of equipment

Signature of physician*

Registration number*

Address

Part B: To be Completed by Purchaser

Name of vendor

Address

Signed under the penalties of perjury.

Signature of purchaser

Address

General Information

Under Massachusetts General Laws (MGL), Chapter 64H, sec. 6(I) the

Warning: Willful misuse of this certificate is subject to criminal tax

medical equipment listed above is exempt from sales and use tax if pre-

evasion penalties of up to one year in prison and $10,000 ($50,000

scribed by a physician. The exemption covers sales, rentals and repairs

for corporations) in fines.

of these items. Vendors must collect the tax on sales of the medical

If you have any questions about the acceptance or use of this certificate,

equipment listed unless the purchaser presents this exempt certificate

please contact: Massachusetts Department of Revenue, Customer

properly completed. If the physician does not complete Part A, his or her

Service Bureau, PO Box 7010, Boston, MA 02204; (617) 887-MDOR.

written prescription form may be substituted. Vendors should attach the

prescription to this form. This patient-specific information is not required for

*This information is not required for kidney dialysis machines, which can

kidney dialysis machines. The purchaser must complete Part B. Vendors

only be used under the direction of a physician.

must retain a copy of this form with their tax records to substantiate the

exempt sale. See Massachusetts Regulation 830 CMR 62C.25.1.

This form is approved by the Commissioner of Revenue and may be reproduced.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1