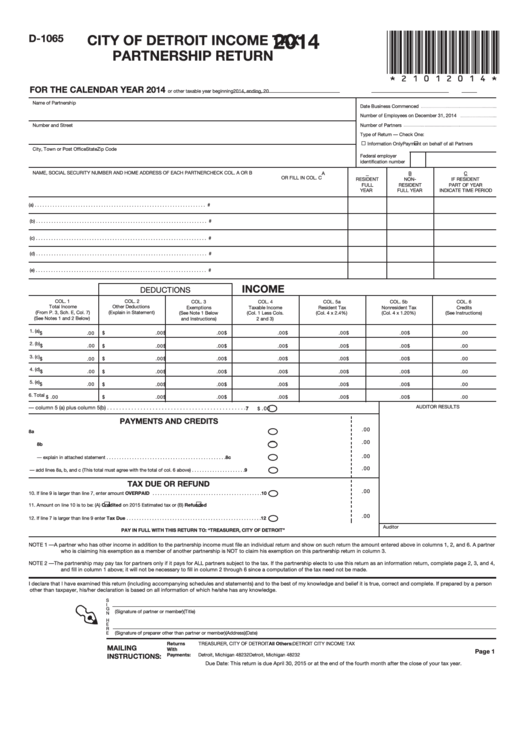

2014

*21012014*

CITY OF DETROIT INCOME TAX

D-1065

PARTNERSHIP RETURN

FOR THE CALENDAR YEAR 2014

or other taxable year beginning

2014, ending

, 20

Name of Partnership

Date Business Commenced

Number of Employees on December 31, 2014

Number and Street

Number of Partners

Type of Return — Check One:

Information Only

Payment on behalf of all Partners

City, Town or Post Office

State

Zip Code

Federal employer

identification number

NAME, SOCIAL SECURITY NUMBER AND HOME ADDRESS OF EACH PARTNER

CHECK COL. A OR B

A

B

C

OR FILL IN COL. C

RESIDENT

NON-

IF RESIDENT

FULL

RESIDENT

PART OF YEAR

YEAR

FULL YEAR

INDICATE TIME PERIOD

(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #

(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #

(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #

(d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #

(e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #

INCOME

DEDUCTIONS

COL. 1

COL. 2

COL. 3

COL. 4

COL. 5a

COL. 5b

COL. 6

Total Income

Other Deductions

Exemptions

Taxable Income

Resident Tax

Nonresident Tax

Credits

(From P. 3, Sch. E, Col. 7)

(Explain in Statement)

(See Note 1 Below

(Col. 1 Less Cols.

(Col. 4 x 2.4%)

(Col. 4 x 1.20%)

(See Instructions)

(See Notes 1 and 2 Below)

and Instructions)

2 and 3)

1. (a) $

.00

$

.00

$

.00

$

.00

$

.00

$

.00

$

.00

2. (b) $

.00

$

.00

$

.00

$

.00

$

.00

$

.00

$

.00

3. (c) $

.00

$

.00

$

.00

$

.00

$

.00

$

.00

$

.00

4. (d) $

.00

$

.00

$

.00

$

.00

$

.00

$

.00

$

.00

5. (e) $

.00

$

.00

$

.00

$

.00

$

.00

$

.00

$

.00

6. Total $

.00

$

.00

$

.00

$

.00

$

.00

$

.00

$

.00

7. Total Tax — column 5 (a) plus column 5(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

AUDITOR RESULTS

.00

$

PAYMENTS AND CREDITS

.00

8. a. Tax paid with tenative return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8a

.00

b. Payments and credits on 2014 Declaration of Estimated Detroit Income Tax . . . . . . . . . . . . . . . . . . . . . . . 8b

.00

c. Other credits — explain in attached statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

.00

9. Total — add lines 8a, b, and c (This total must agree with the total of col. 6 above) . . . . . . . . . . . . . . . . . . . . . 9

TAX DUE OR REFUND

.00

10. If line 9 is larger than line 7, enter amount OVERPAID . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11. Amount on line 10 is to be: (A)

Credited on 2015 Estimated tax or (B)

Refunded

.00

12. If line 7 is larger than line 9 enter Tax Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Auditor

PAY IN FULL WITH THIS RETURN TO: “TREASURER, CITY OF DETROIT”

NOTE 1 —

A partner who has other income in addition to the partnership income must file an individual return and show on such return the amount entered above in columns 1, 2, and 6. A partner

who is claiming his exemption as a member of another partnership is NOT to claim his exemption on this partnership return in column 3.

NOTE 2 —

The partnership may pay tax for partners only if it pays for ALL partners subject to the tax. If the partnership elects to use this return as an information return, complete page 2, 3, and 4,

and fill in column 1 above; it will not be necessary to fill in column 2 through 6 since a computation of the tax need not be made.

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person

other than taxpayer, his/her declaration is based on all information of which he/she has any knowledge.

S

I

G

(Signature of partner or member)

(Title)

N

H

E

R

(Signature of preparer other than partner or member)

(Address)

(Date)

E

Returns

TREASURER, CITY OF DETROIT

All Others:

DETROIT CITY INCOME TAX

MAILING

With

P.O. Box 33406

P.O. BOX 33406

Page 1

INSTRUCTIONS:

Payments:

Detroit, Michigan 48232

Detroit, Michigan 48232

Due Date: This return is due April 30, 2015 or at the end of the fourth month after the close of your tax year.

1

1 2

2 3

3 4

4