Form It-20g - Governmental Units And Agencies Gross Income Tax Return

ADVERTISEMENT

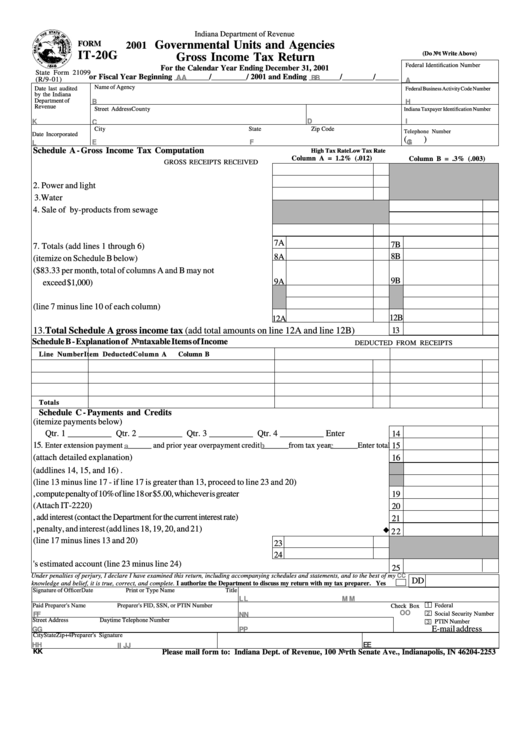

Indiana Department of Revenue

Governmental Units and Agencies

FORM

2001

IT-20G

(Do Not Write Above)

Gross Income Tax Return

Federal Identification Number

For the Calendar Year Ending December 31, 2001

State Form 21099

or Fiscal Year Beginning _________/_________/ 2001 and Ending ________/________/______

AA

BB

(R/9-01)

A

Name of Agency

Date last audited

Federal Business Activity Code Number

by the Indiana

Department of

B

H

Revenue

Street Address

County

Indiana Taxpayer Identification Number

D

I

K

C

City

State

Zip Code

Telephone Number

Date Incorporated

(

)

J

E

F

G

L

Schedule A - Gross Income Tax Computation

High Tax Rate

Low Tax Rate

Column A = 1.2% (.012)

Column B = .3% (.003)

GROSS RECEIPTS RECEIVED

1. Gas ................................................................................................

2. Power and light ...............................................................................

3. Water ..............................................................................................

4. Sale of by-products from sewage utility ........................................

5. Concession stand receipts .............................................................

6. Miscellaneous income ....................................................................

7A

7B

7. Totals (add lines 1 through 6) .........................................................

8B

8A

8. Nontaxable receipts (itemize on Schedule B below) ........................

9. Exemption ($83.33 per month, total of columns A and B may not

9B

9A

exceed $1,000) .................................................................................

10.Add lines 8 and 9 for each column .................................................

11.Amounts subject to tax (line 7 minus line 10 of each column) ........

12B

12.Multiply amounts on line 11 by the tax rate for each column .........

12A

.............

13.Total Schedule A gross income tax (add total amounts on line 12A and line 12B)

13

Schedule B - Explanation of Nontaxable Items of Income

DEDUCTED FROM RECEIPTS

Line Number

Item Deducted

Column A

Column B

Totals

Schedule C - Payments and Credits

14. Total quarterly IT-6 or EFT estimated payments (itemize payments below)

Qtr. 1 __________ Qtr. 2 __________ Qtr. 3 __________ Qtr. 4 __________ Enter total ...........

14

15.

Enter extension payment _______ and prior year overpayment credit _______from tax year_______Enter total

b

c

a

15

16. Other credits (attach detailed explanation) .........................................................................................

16

17. Total payments and credits (add lines 14, 15, and 16) ........................................................................

18. Balance of tax due (line 13 minus line 17 - if line 17 is greater than 13, proceed to line 23 and 20) ......

19. If payment is made after the original due date, compute penalty of 10% of line 18 or $5.00, whichever is greater

19

20. Penalty for the underpayment of quarterly tax from Schedule IT-2220 (Attach IT-2220) ....................

20

21. If payment is made after the original due date, add interest (contact the Department for the current interest rate)

21

22. Total tax, penalty, and interest (add lines 18, 19, 20, and 21) ........................................Pay this amount

22

23. Total overpayment (line 17 minus lines 13 and 20) .......................

23

24. Amount of line 23 to be refunded .................................................

24

25. Amount of line 23 to be credited to the following year's estimated account (line 23 minus line 24).....

25

Under penalties of perjury, I declare I have examined this return, including accompanying schedules and statements, and to the best of my

CC

DD

knowledge and belief, it is true, correct, and complete. I authorize the Department to discuss my return with my tax preparer. Yes

Signature of Officer

Date

Print or Type Name

Title

LL

M M

1

Paid Preparer's Name

Preparer's FID, SSN, or PTIN Number

Check Box

Federal I.D. Number

OO

2

Social Security Number

FF

NN

Street Address

Daytime Telephone Number

PTIN Number

3

E-mail address

GG

PP

City

State

Zip+4

Preparer's Signature

HH

EE

II

JJ

KK

Please mail form to: Indiana Dept. of Revenue, 100 North Senate Ave., Indianapolis, IN 46204-2253

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1