Form Rp-485-F - Application For Real Property Tax Exemption For Branch Bank In Banking Development District - 1999

ADVERTISEMENT

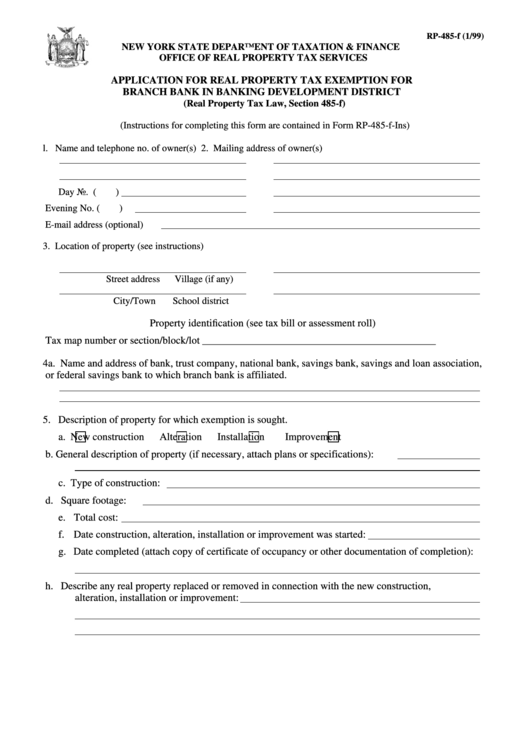

RP-485-f (1/99)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR

BRANCH BANK IN BANKING DEVELOPMENT DISTRICT

(Real Property Tax Law, Section 485-f)

(Instructions for completing this form are contained in Form RP-485-f-Ins)

l.

Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail address (optional)

3. Location of property (see instructions)

Street address

Village (if any)

City/Town

School district

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot

________________________________________________

4a. Name and address of bank, trust company, national bank, savings bank, savings and loan association,

or federal savings bank to which branch bank is affiliated.

5. Description of property for which exemption is sought.

a.

New construction

Alteration

Installation

Improvement

b. General description of property (if necessary, attach plans or specifications):

c. Type of construction:

d. Square footage:

e. Total cost:

f. Date construction, alteration, installation or improvement was started:

g. Date completed (attach copy of certificate of occupancy or other documentation of completion):

h. Describe any real property replaced or removed in connection with the new construction,

alteration, installation or improvement:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2