Form Rp-485-B - Application For Real Property Tax Exemption For Commercial, Business Or Industrial Property - 1995

ADVERTISEMENT

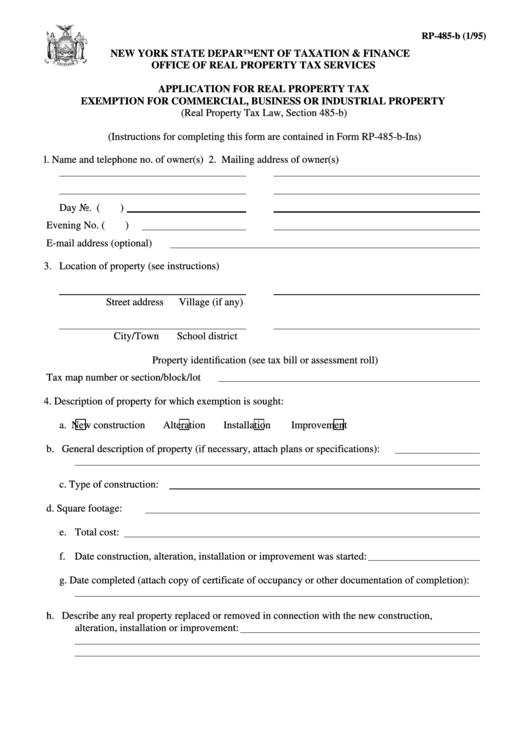

RP-485-b (1/95)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR REAL PROPERTY TAX

EXEMPTION FOR COMMERCIAL, BUSINESS OR INDUSTRIAL PROPERTY

(Real Property Tax Law, Section 485-b)

(Instructions for completing this form are contained in Form RP-485-b-Ins)

l. Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail address (optional)

3. Location of property (see instructions)

Street address

Village (if any)

City/Town

School district

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot

4. Description of property for which exemption is sought:

a.

New construction

Alteration

Installation

Improvement

b. General description of property (if necessary, attach plans or specifications):

c. Type of construction:

d. Square footage:

e. Total cost:

f. Date construction, alteration, installation or improvement was started:

g. Date completed (attach copy of certificate of occupancy or other documentation of completion):

h. Describe any real property replaced or removed in connection with the new construction,

alteration, installation or improvement:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2