Mary Kay Independent Consultant Tax Worksheet

ADVERTISEMENT

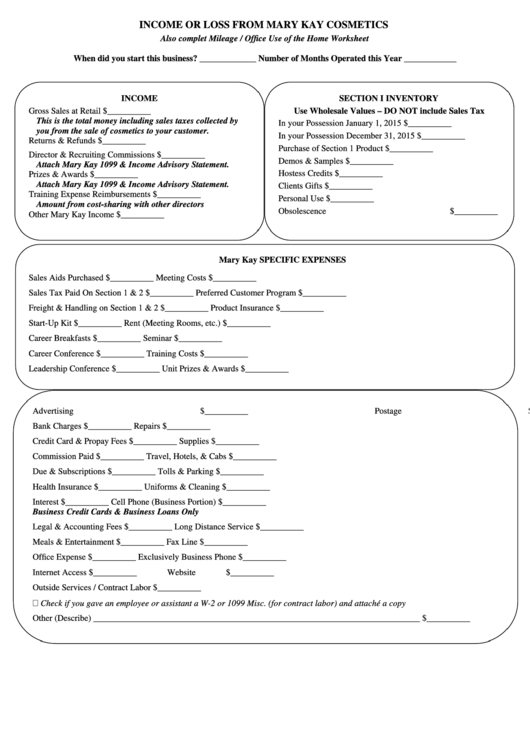

INCOME OR LOSS FROM MARY KAY COSMETICS

Also complet Mileage / Office Use of the Home Worksheet

When did you start this business? _____________ Number of Months Operated this Year ____________

INCOME

SECTION I INVENTORY

Gross Sales at Retail

$__________

Use Wholesale Values – DO NOT include Sales Tax

This is the total money including sales taxes collected by

In your Possession January 1, 2015

$__________

you from the sale of cosmetics to your customer.

In your Possession December 31, 2015

$__________

Returns & Refunds

$__________

Purchase of Section 1 Product

$__________

Director & Recruiting Commissions

$__________

Demos & Samples

$__________

Attach Mary Kay 1099 & Income Advisory Statement.

Hostess Credits

$__________

Prizes & Awards

$__________

Attach Mary Kay 1099 & Income Advisory Statement.

Clients Gifts

$__________

Training Expense Reimbursements

$__________

Personal Use

$__________

Amount from cost-sharing with other directors

Obsolescence

$__________

Other Mary Kay Income

$__________

Mary Kay SPECIFIC EXPENSES

Sales Aids Purchased

$__________

Meeting Costs

$__________

Sales Tax Paid On Section 1 & 2

$__________

Preferred Customer Program

$__________

Freight & Handling on Section 1 & 2

$__________

Product Insurance

$__________

Start-Up Kit

$__________

Rent (Meeting Rooms, etc.)

$__________

Career Breakfasts

$__________

Seminar

$__________

Career Conference

$__________

Training Costs

$__________

Leadership Conference

$__________

Unit Prizes & Awards

$__________

Advertising

$__________

Postage

$__________

Bank Charges

$__________

Repairs

$__________

Credit Card & Propay Fees

$__________

Supplies

$__________

Commission Paid

$__________

Travel, Hotels, & Cabs

$__________

Due & Subscriptions

$__________

Tolls & Parking

$__________

Health Insurance

$__________

Uniforms & Cleaning

$__________

Interest

$__________

Cell Phone (Business Portion)

$__________

Business Credit Cards & Business Loans Only

Legal & Accounting Fees

$__________

Long Distance Service

$__________

Meals & Entertainment

$__________

Fax Line

$__________

Office Expense

$__________

Exclusively Business Phone

$__________

Internet Access

$__________

Website

$__________

Outside Services / Contract Labor

$__________

Check if you gave an employee or assistant a W-2 or 1099 Misc. (for contract labor) and attaché a copy

Other (Describe) ___________________________________________________________________________

$__________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1