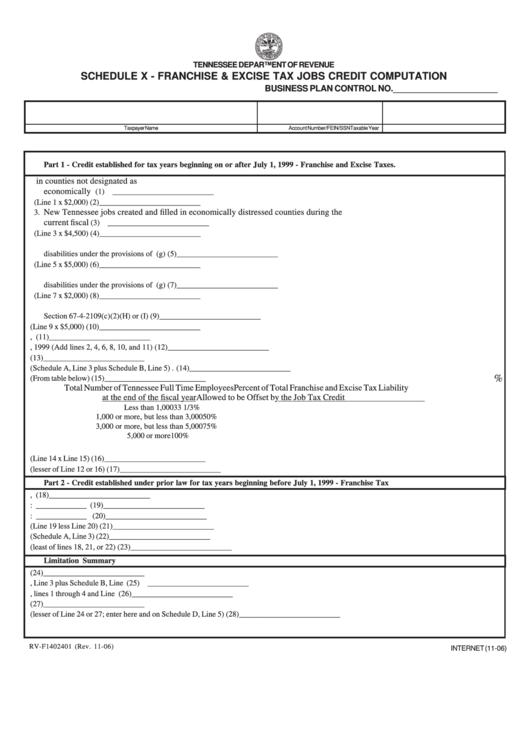

TENNESSEE DEPARTMENT OF REVENUE

SCHEDULE X - FRANCHISE & EXCISE TAX JOBS CREDIT COMPUTATION

BUSINESS PLAN CONTROL NO. ______________________

Taxpayer Name

Account Number/FEIN/SSN

Taxable Year

Part 1 - Credit established for tax years beginning on or after July 1, 1999 - Franchise and Excise Taxes.

in counties not designated as

1. New Tennessee jobs created and filled during the current fiscal year

economically distressed ........................................................................................................................

(1) __________________________

2. Jobs Tax Credit from jobs created (Line 1 x $2,000) ............................................................................................. (2) __________________________

New Tennessee jobs created and filled in economically distressed counties during the

3.

current fiscal year ..................................................................................................................................

(3) __________________________

4. Jobs Tax Credit from jobs created in distressed counties (Line 3 x $4,500) ......................................................... (4) __________________________

5. New full time Tennessee jobs created and filled during the current fiscal year by qualified persons with

disabilities under the provisions of T.C.A. 67-4-2109(g) ..................................................................................... (5) __________________________

6. Jobs Tax Credit from jobs created (Line 5 x $5,000) ............................................................................................. (6) __________________________

7. New part time Tennessee jobs created and filled during the current fiscal year by qualified persons with

disabilities under the provisions of T.C.A. 67-4-2109(g) ..................................................................................... (7) __________________________

8. Jobs Tax Credit from jobs created (Line 7 x $2,000) ............................................................................................. (8) __________________________

9. New Tennessee jobs created and filled during the current fiscal year under the provisions of T.C.A.

Section 67-4-2109(c)(2)(H) or (I) .......................................................................................................................... (9) __________________________

10. Jobs Tax Credit from jobs created (Line 9 x $5,000) ........................................................................................... (10) __________________________

11. Jobs Tax Credit carryover from years beginning on or after July 1, 1999 .......................................................... (11) __________________________

12. Total Jobs Tax Credit from years beginning on or after July 1, 1999 (Add lines 2, 4, 6, 8, 10, and 11) ............ (12) __________________________

13. Total Tennessee Jobs at Fiscal Year End ............................................................................................................ (13) __________________________

14. Total Franchise and Excise Taxes (Schedule A, Line 3 plus Schedule B, Line 5) ................................................ (14) __________________________

%

15. Limitation Percentage (From table below) ........................................................................................................... (15) __________________________

Total Number of Tennessee Full Time Employees

Percent of Total Franchise and Excise Tax Liability

at the end of the fiscal year

Allowed to be Offset by the Job Tax Credit

Less than 1,000

33 1/3%

1,000 or more, but less than 3,000

50%

3,000 or more, but less than 5,000

75%

5,000 or more

100%

16. Limitation (Line 14 x Line 15) ............................................................................................................................. (16) __________________________

17. Credit available in current year (lesser of Line 12 or 16) ..................................................................................... (17) __________________________

Part 2 - Credit established under prior law for tax years beginning before July 1, 1999 - Franchise Tax

18. Jobs Tax Credit carryover from years beginning before July 1, 1999 ................................................................. (18) __________________________

19. Franchise Tax Liability on return first reflecting increase ............................................ Year: _____________ (19) __________________________

20. Franchise Tax from year immediately prior to investment .......................................... Year: _____________ (20) __________________________

21. Limitation (Line 19 less Line 20) ......................................................................................................................... (21) __________________________

22. Franchise Tax (Schedule A, Line 3) ..................................................................................................................... (22) __________________________

23. Credit Available in current year (least of lines 18, 21, or 22) .............................................................................. (23) __________________________

Limitation Summary

24. Line 17 plus Line 23 ............................................................................................................................................ (24) __________________________

25. Total Franchise and Excise Taxes from Schedule A, Line 3 plus Schedule B, Line 5 .......................................... (25) __________________________

26. Credit from Schedule D, lines 1 through 4 and Line 6 ......................................................................................... (26) __________________________

27. Net Tax before Jobs Credit from Line 25 less Line 26 ........................................................................................ (27) __________________________

28. Total amount available in current year (lesser of Line 24 or 27; enter here and on Schedule D, Line 5) ............. (28) __________________________

RV-F1402401 (Rev. 11-06)

INTERNET (11-06)

1

1 2

2