Individual Income Tax Return Form - Instructions

ADVERTISEMENT

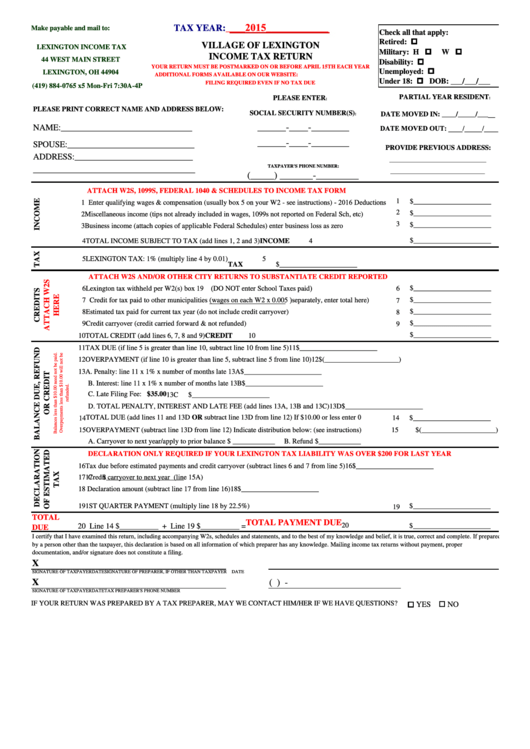

_2015_

TAX YEAR:

___

____________

Make payable and mail to:

Check all that apply:

Retired: p

VILLAGE OF LEXINGTON

LEXINGTON INCOME TAX

Military: H p

W p

INCOME TAX RETURN

44 WEST MAIN STREET

Disability: p

YOUR RETURN MUST BE POSTMARKED ON OR BEFORE APRIL 15TH EACH YEAR

Unemployed: p

LEXINGTON, OH 44904

ADDITIONAL FORMS AVAILABLE ON OUR WEBSITE:

Under 18: p DOB: ___/___/___

FILING REQUIRED EVEN IF NO TAX DUE

(419) 884-0765 x5 Mon-Fri 7:30A-4P

PARTIAL YEAR RESIDENT

PLEASE ENTER

:

:

PLEASE PRINT CORRECT NAME AND ADDRESS BELOW:

SOCIAL SECURITY NUMBER(S)

DATE MOVED IN: ____/_____/_____

:

______-____-________

DATE MOVED OUT: ____/_____/____

NAME:______________________________

______-____-________

SPOUSE:_____________________________

PROVIDE PREVIOUS ADDRESS:

ADDRESS:___________________________

_________________________________________

TAXPAYER'S PHONE NUMBER:

_____________________________________

________________________________________

(_____) _______-_________

ATTACH W2S, 1099S, FEDERAL 1040 & SCHEDULES TO INCOME TAX FORM

1 Enter qualifying wages & compensation (usually box 5 on your W2 - see instructions) - 2016 Deductions

1

$______________________

2

$______________________

2 Miscellaneous income (tips not already included in wages, 1099s not reported on Federal Sch, etc)

3

$______________________

3 Business income (attach copies of applicable Federal Schedules) enter business loss as zero

$______________________

4 TOTAL INCOME SUBJECT TO TAX (add lines 1, 2 and 3)

INCOME

4

5 LEXINGTON TAX: 1% (multiply line 4 by 0.01)

5

TAX

$______________________

ATTACH W2S AND/OR OTHER CITY RETURNS TO SUBSTANTIATE CREDIT REPORTED

6 Lexington tax withheld per W2(s) box 19

(DO NOT enter School Taxes paid)

$______________________

6

7 Credit for tax paid to other municipalities (wages on each W2 x 0.005 )separately, enter total here)

$______________________

7

8 Estimated tax paid for current tax year (do not include credit carryover)

8

$______________________

$______________________

9 Credit carryover (credit carried forward & not refunded)

9

$______________________

10 TOTAL CREDIT (add lines 6, 7, 8 and 9)

CREDIT

10

11 TAX DUE (if line 5 is greater than line 10, subtract line 10 from line 5)

11

$______________________

12 OVERPAYMENT (if line 10 is greater than line 5, subtract line 5 from line 10)

12

$(_____________________)

13 A. Penalty: line 11 x 1% x number of months late

13A

$______________________

B. Interest: line 11 x 1% x number of months late

13B

$______________________

C. Late Filing Fee: $35.00

13C

$______________________

D. TOTAL PENALTY, INTEREST AND LATE FEE (add lines 13A, 13B and 13C)

13D

$______________________

14 TOTAL DUE (add lines 11 and 13D OR subtract line 13D from line 12) If $10.00 or less enter 0

14

$______________________

15

$(_____________________)

15 OVERPAYMENT (subtract line 13D from line 12) Indicate distribution below: (see instructions)

A. Carryover to next year/apply to prior balance $ ____________

B. Refund $____________

DECLARATION ONLY REQUIRED IF YOUR LEXINGTON TAX LIABILITY WAS OVER $200 FOR LAST YEAR

16 Tax due before estimated payments and credit carryover (subtract lines 6 and 7 from line 5)

16

$______________________

17

Credit carryover to next year (line 15A)

17

$______________________

18 Declaration amount (subtract line 17 from line 16)

18

$______________________

19 1ST QUARTER PAYMENT (multiply line 18 by 22.5%)

$______________________

19

TOTAL

TOTAL PAYMENT DUE

20

20 Line 14 $__________ + Line 19 $__________ =

$______________________

DUE

I certify that I have examined this return, including accompanying W2s, schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. If prepared

by a person other than the taxpayer, this declaration is based on all information of which preparer has any knowledge. Mailing income tax returns without payment, proper

documentation, and/or signature does not constitute a filing.

X

SIGNATURE OF TAXPAYER

DATE

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER

DATE

X

(

)

-

SIGNATURE OF TAXPAYER

DATE

TAX PREPARER'S PHONE NUMBER

YES o NO

IF YOUR RETURN WAS PREPARED BY A TAX PREPARER, MAY WE CONTACT HIM/HER IF WE HAVE QUESTIONS?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2