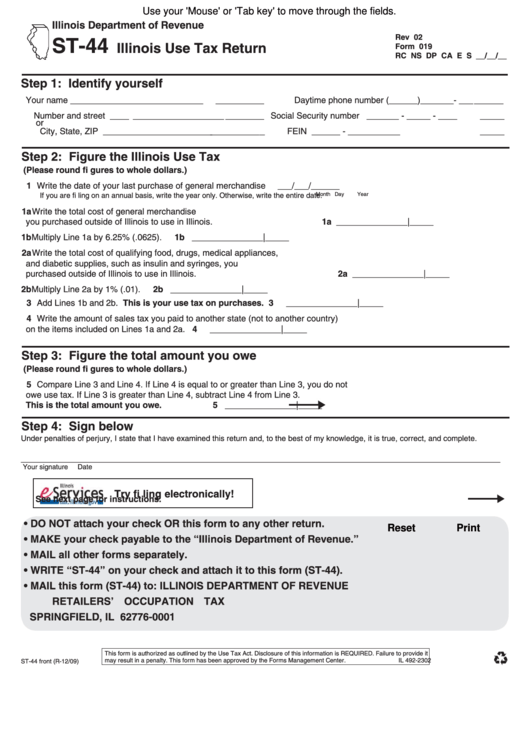

Use your 'Mouse' or 'Tab key' to move through the fields.

Illinois Department of Revenue

Rev 02

ST-44

Illinois Use Tax Return

Form 019

RC NS DP CA E S __/__/__

Step 1: Identify yourself

Your name ______________________________________

Daytime phone number (______)_______- _________

Number and street _______________________________

Social Security number _______ - _____ - _________

or

City, State, ZIP __________________________________

FEIN

______ - ________________

Step 2: Figure the Illinois Use Tax

(Please round fi gures to whole dollars.)

1 Write the date of your last purchase of general merchandise

___/___/______

Month Day

Year

If you are fi ling on an annual basis, write the year only. Otherwise, write the entire date.

1a Write the total cost of general merchandise

you purchased outside of Illinois to use in Illinois.

1a _______________|_____

1b Multiply Line 1a by 6.25% (.0625).

1b

_______________|_____

2a Write the total cost of qualifying food, drugs, medical appliances,

and diabetic supplies, such as insulin and syringes, you

purchased outside of Illinois to use in Illinois.

2a _______________|_____

2b Multiply Line 2a by 1% (.01).

2b

_______________|_____

3 Add Lines 1b and 2b. This is your use tax on purchases.

3

_______________|_____

4 Write the amount of sales tax you paid to another state (not to another country)

on the items included on Lines 1a and 2a.

4

_______________|_____

Step 3: Figure the total amount you owe

(Please round fi gures to whole dollars.)

5 Compare Line 3 and Line 4. If Line 4 is equal to or greater than Line 3, you do not

owe use tax. If Line 3 is greater than Line 4, subtract Line 4 from Line 3.

This is the total amount you owe.

5

_______________|_____

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_____________________________________________________________________________________________________

Your signature

Date

Try fi ling electronically!

See next page for instructions.

• DO NOT attach your check OR this form to any other return.

Reset

Print

• MAKE your check payable to the “Illinois Department of Revenue.”

• MAIL all other forms separately.

• WRITE “ST-44” on your check and attach it to this form (ST-44).

• MAIL this form (ST-44) to:

ILLINOIS DEPARTMENT OF REVENUE

RETAILERS’ OCCUPATION TAX

SPRINGFIELD, IL 62776-0001

This form is authorized as outlined by the Use Tax Act. Disclosure of this information is REQUIRED. Failure to provide it

may result in a penalty. This form has been approved by the Forms Management Center.

IL 492-2302

ST-44 front (R-12/09)

1

1