Form BB-1 Instructions (Rev. 2015)

PURPOSE OF FORM

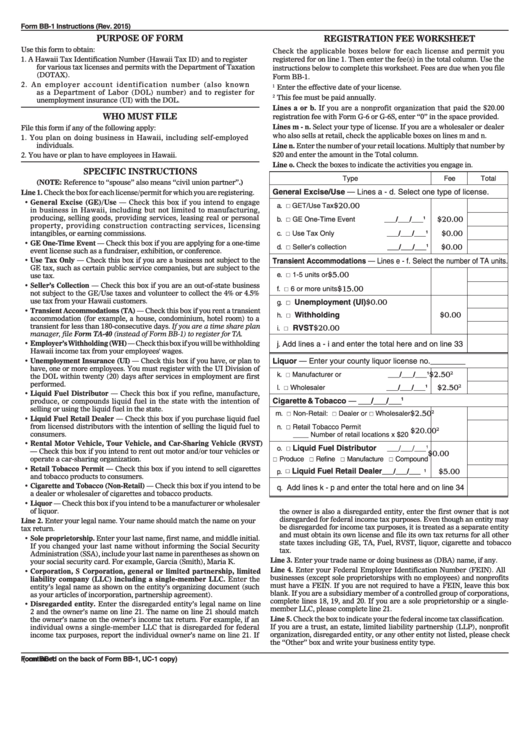

REGISTRATION FEE WORKSHEET

Use this form to obtain:

Check the applicable boxes below for each license and permit you

1.

A Hawaii Tax Identification Number (Hawaii Tax ID) and to register

registered for on line 1. Then enter the fee(s) in the total column. Use the

for various tax licenses and permits with the Department of Taxation

instructions below to complete this worksheet. Fees are due when you file

(DOTAX).

Form BB-1.

2.

An employer account identification number (also known

Enter the effective date of your license.

1

as a Department of Labor (DOL) number) and to register for

This fee must be paid annually.

2

unemployment insurance (UI) with the DOL.

Lines a or b. If you are a nonprofit organization that paid the $20.00

WHO MUST FILE

registration fee with Form G-6 or G-6S, enter “0” in the space provided.

Lines m - n. Select your type of license. If you are a wholesaler or dealer

File this form if any of the following apply:

who also sells at retail, check the applicable boxes on lines m and n.

1.

You plan on doing business in Hawaii, including self-employed

individuals.

Line n. Enter the number of your retail locations. Multiply that number by

$20 and enter the amount in the Total column.

2.

You have or plan to have employees in Hawaii.

Line o. Check the boxes to indicate the activities you engage in.

SPECIFIC INSTRUCTIONS

Type

Fee

Total

(NOTE: Reference to “spouse” also means “civil union partner”.)

General Excise/Use — Lines a - d. Select one type of license.

Line 1. Check the box for each license/permit for which you are registering.

• General Excise (GE)/Use — Check this box if you intend to engage

$20.00

a. GET/Use Tax

in business in Hawaii, including but not limited to manufacturing,

producing, selling goods, providing services, leasing real or personal

$20.00

b. GE One-Time Event

___/___/___

1

property, providing construction contracting services, licensing

$0.00

intangibles, or earning commissions.

___/___/___

c. Use Tax Only

1

• GE One-Time Event — Check this box if you are applying for a one-time

$0.00

d. Seller’s collection

___/___/___

1

event license such as a fundraiser, exhibition, or conference.

• Use Tax Only — Check this box if you are a business not subject to the

Transient Accommodations — Lines e - f. Select the number of TA units.

GE tax, such as certain public service companies, but are subject to the

$5.00

e. 1-5 units or

use tax.

• Seller’s Collection — Check this box if you are an out-of-state business

$15.00

f. 6 or more units

not subject to the GE/Use taxes and volunteer to collect the 4% or 4.5%

use tax from your Hawaii customers.

Unemployment (UI)

$0.00

g.

• Transient Accommodations (TA) — Check this box if you rent a transient

Withholding

$0.00

h.

accommodation (for example, a house, condominium, hotel room) to a

transient for less than 180-consecutive days. If you are a time share plan

RVST

$20.00

i.

manager, file Form TA-40 (instead of Form BB-1) to register for TA.

• Employer’s Withholding (WH) — Check this box if you will be withholding

j. Add lines a - i and enter the total here and on line 33

Hawaii income tax from your employees' wages.

• Unemployment Insurance (UI) — Check this box if you have, or plan to

Liquor — Enter your county liquor license no.________

have, one or more employees. You must register with the UI Division of

$2.50

___/___/___

2

k. Manufacturer or

1

the DOL within twenty (20) days after services in employment are first

performed.

$2.50

l. Wholesaler

___/___/___

2

1

• Liquid Fuel Distributor — Check this box if you refine, manufacture,

Cigarette & Tobacco — ___/___/___

produce, or compounds liquid fuel in the state with the intention of

1

selling or using the liquid fuel in the state.

$2.50

m. Non-Retail: Dealer or Wholesaler

2

• Liquid Fuel Retail Dealer — Check this box if you purchase liquid fuel

from licensed distributors with the intention of selling the liquid fuel to

n. Retail Tobacco Permit

$20.00

2

consumers.

____ Number of retail locations x $20

• Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle (RVST)

Liquid Fuel Distributor

o.

___/___/___

1

— Check this box if you intend to rent out motor and/or tour vehicles or

$0.00

operate a car-sharing organization.

Produce Refine Manufacture Compound

• Retail Tobacco Permit — Check this box if you intend to sell cigarettes

Liquid Fuel Retail Dealer

$5.00

p.

___/___/___

1

and tobacco products to consumers.

• Cigarette and Tobacco (Non-Retail) — Check this box if you intend to be

q. Add lines k - p and enter the total here and on line 34

a dealer or wholesaler of cigarettes and tobacco products.

• Liquor — Check this box if you intend to be a manufacturer or wholesaler

of liquor.

the owner is also a disregarded entity, enter the first owner that is not

disregarded for federal income tax purposes. Even though an entity may

Line 2. Enter your legal name. Your name should match the name on your

be disregarded for income tax purposes, it is treated as a separate entity

tax return.

and must obtain its own license and file its own tax returns for all other

• Sole proprietorship. Enter your last name, first name, and middle initial.

state taxes including GE, TA, Fuel, RVST, liquor, cigarette and tobacco

If you changed your last name without informing the Social Security

tax.

Administration (SSA), include your last name in parentheses as shown on

Line 3. Enter your trade name or doing business as (DBA) name, if any.

your social security card. For example, Garcia (Smith), Maria K.

Line 4. Enter your Federal Employer Identification Number (FEIN). All

• Corporation, S Corporation, general or limited partnership, limited

businesses (except sole proprietorships with no employees) and nonprofits

liability company (LLC) including a single-member LLC. Enter the

must have a FEIN. If you are not required to have a FEIN, leave this box

entity’s legal name as shown on the entity’s organizing document (such

blank. If you are a subsidiary member of a controlled group of corporations,

as your articles of incorporation, partnership agreement).

complete lines 18, 19, and 20. If you are a sole proprietorship or a single-

• Disregarded entity. Enter the disregarded entity’s legal name on line

member LLC, please complete line 21.

2 and the owner’s name on line 21. The name on line 21 should match

Line 5. Check the box to indicate your the federal income tax classification.

the owner’s name on the owner’s income tax return. For example, if an

If you are a trust, an estate, limited liability partnership (LLP), nonprofit

individual owns a single-member LLC that is disregarded for federal

organization, disregarded entity, or any other entity not listed, please check

income tax purposes, report the individual owner’s name on line 21. If

the “Other” box and write your business entity type.

Form BB-1

(continued on the back of Form BB-1, UC-1 copy)

1

1 2

2