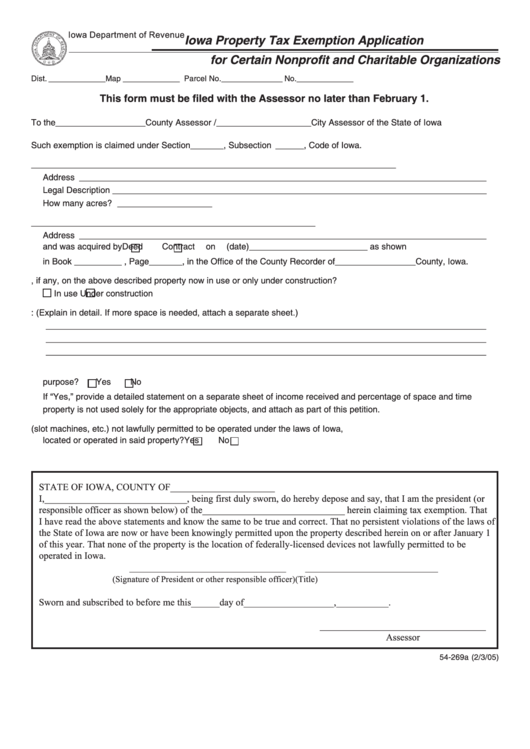

Form 54-269a - Iowa Property Tax Exemption Application For Certain Nonprofit And Charitable Organizations

ADVERTISEMENT

Iowa Department of Revenue

Iowa Property Tax Exemption Application

for Certain Nonprofit and Charitable Organizations

Dist. _____________ Map _____________ Parcel No. ______________ No. _____________

This form must be filed with the Assessor no later than February 1.

To the ___________________ County Assessor / ____________________ City Assessor of the State of Iowa

Such exemption is claimed under Section _______ , Subsection ______ , Code of Iowa.

1. Institution or Society _____________________________________________________________________________

Address ______________________________________________________________________________________

Legal Description _______________________________________________________________________________

How many acres? ____________________

2. The title to said property is in the name of ____________________________________________________________

Address ______________________________________________________________________________________

and was acquired by

Deed

Contract

on (date) _________________________ as shown

in Book __________ , Page _______ , in the Office of the County Recorder of _________________ County, Iowa.

3. Is the building, if any, on the above described property now in use or only under construction?

In use

Under construction

4. Property is used for the following purposes: (Explain in detail. If more space is needed, attach a separate sheet.)

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

5. Is any portion of this property rented/leased or otherwise used with a view to pecuniary profit or for a commercial

purpose?

Yes

No

If “Yes,” provide a detailed statement on a separate sheet of income received and percentage of space and time

property is not used solely for the appropriate objects, and attach as part of this petition.

6. Are federally-licensed devices (slot machines, etc.) not lawfully permitted to be operated under the laws of Iowa,

located or operated in said property?

Yes

No

STATE OF IOWA, COUNTY OF ______________________

I, ______________________________ , being first duly sworn, do hereby depose and say, that I am the president (or

responsible officer as shown below) of the ______________________________ herein claiming tax exemption. That

I have read the above statements and know the same to be true and correct. That no persistent violations of the laws of

the State of Iowa are now or have been knowingly permitted upon the property described herein on or after January 1

of this year. That none of the property is the location of federally-licensed devices not lawfully permitted to be

operated in Iowa.

_________________________________

____________________________

(Signature of President or other responsible officer)

(Title)

Sworn and subscribed to before me this ______ day of ___________________ , ___________ .

___________________________________

Assessor

54-269a (2/3/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1