Form W-3 - Batavia Withholding Tax Reconciliation Form

ADVERTISEMENT

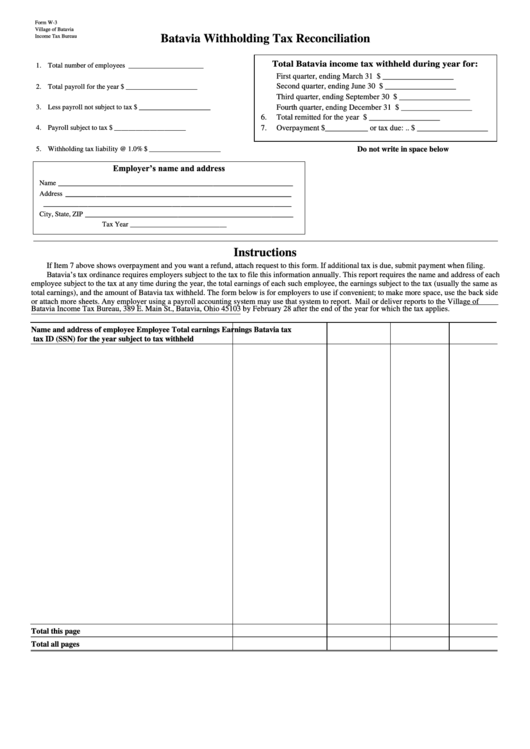

Form W-3

Village of Batavia

Income Tax Bureau

Batavia Withholding Tax Reconciliation

Total Batavia income tax withheld during year for:

1. Total number of employees

_____________________

First quarter, ending March 31 .................. $ __________________

2. Total payroll for the year

$ ____________________

Second quarter, ending June 30 ................. $ __________________

Third quarter, ending September 30 .......... $ __________________

Fourth quarter, ending December 31 ......... $ __________________

3. Less payroll not subject to tax

$ ____________________

6.

Total remitted for the year ......................... $ __________________

7.

Overpayment $___________ or tax due: .. $ __________________

4. Payroll subject to tax

$ ____________________

5. Withholding tax liability @ 1.0%

$ ____________________

Do not write in space below

Employer’s name and address

_____________________________________________________

Name

___________________________________________________

Address

________________________________________________________

_______________________________________________

City, State, ZIP

Tax Year ___________________________

Instructions

If Item 7 above shows overpayment and you want a refund, attach request to this form. If additional tax is due, submit payment when filing.

Batavia’s tax ordinance requires employers subject to the tax to file this information annually. This report requires the name and address of each

employee subject to the tax at any time during the year, the total earnings of each such employee, the earnings subject to the tax (usually the same as

total earnings), and the amount of Batavia tax withheld. The form below is for employers to use if convenient; to make more space, use the back side

or attach more sheets. Any employer using a payroll accounting system may use that system to report. Mail or deliver reports to the Village of

Batavia Income Tax Bureau, 389 E. Main St., Batavia, Ohio 45103 by February 28 after the end of the year for which the tax applies.

Name and address of employee

Employee

Total earnings

Earnings

Batavia tax

tax ID (SSN)

for the year

subject to tax

withheld

Total this page

Total all pages

ADVERTISEMENT

0 votes

1

1