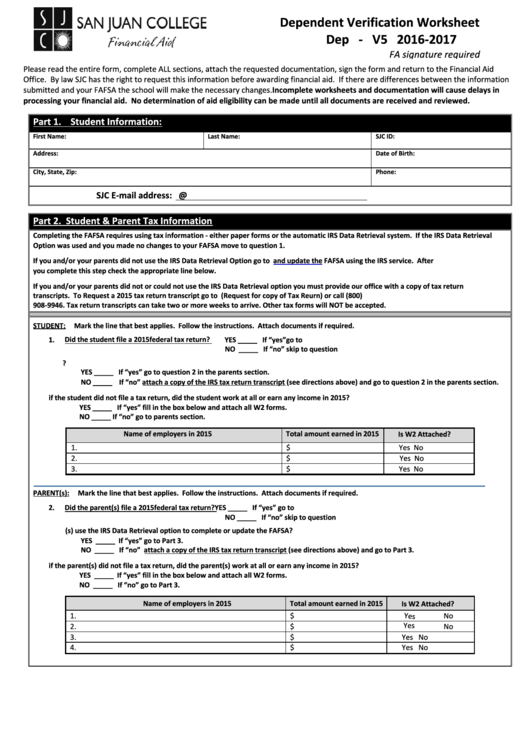

Dependent Verification Worksheet

Dep - V5

2016-2017

FA signature required

Please read the entire form, complete ALL sections, attach the requested documentation, sign the form and return to the Financial Aid

Office. By law SJC has the right to request this information before awarding financial aid. If there are differences between the information

submitted and your FAFSA the school will make the necessary changes. Incomplete worksheets and documentation will cause delays in

processing your financial aid. No determination of aid eligibility can be made until all documents are received and reviewed.

Part 1. Student Information:

First Name:

Last Name:

SJC ID:

Address:

Date of Birth:

City, State, Zip:

Phone:

SJC E-mail address:

@my.sanjuancollege.edu

Part 2. Student & Parent Tax Information

Completing the FAFSA requires using tax information - either paper forms or the automatic IRS Data Retrieval system. If the IRS Data Retrieval

Option was used and you made no changes to your FAFSA move to question 1.

If you and/or your parents did not use the IRS Data Retrieval Option go to

and update the FAFSA using the IRS service. After

you complete this step check the appropriate line below.

If you and/or your parents did not or could not use the IRS Data Retrieval option you must provide our office with a copy of tax return

transcripts. To Request a 2015 tax return transcript go to or complete form 4056 (Request for copy of Tax Reurn) or call (800)

908-9946. Tax return transcripts can take two or more weeks to arrive. Other tax forms will NOT be accepted.

STUDENT:

Mark the line that best applies. Follow the instructions. Attach documents if required.

1.

Did the student file a 2015 federal tax return?

YES _____ If “yes” go to 1.a.

NO _____ If “no” skip to question 1.b.

1.a. Did the student use the IRS Data Retrieval option to complete or update the FAFSA?

YES _____ If “yes” go to question 2 in the parents section.

NO _____ If “no” attach a copy of the IRS tax return transcript (see directions above) and go to question 2 in the parents section.

1.b. Even if the student did not file a tax return, did the student work at all or earn any income in 2015?

YES _____ If “yes” fill in the box below and attach all W2 forms.

NO _____ If “no” go to parents section.

Name of employers in 2015

Total amount earned in 2015

Is W2 Attached?

1.

$

Yes

No

2.

$

Yes

No

3.

$

Yes

No

PARENT(s):

Mark the line that best applies. Follow the instructions. Attach documents if required.

2.

Did the parent(s) file a 2015 federal tax return? YES _____ If “yes” go to 2.a.

NO _____ If “no” skip to question 2.b.

2.a. Did the parent(s) use the IRS Data Retrieval option to complete or update the FAFSA?

YES _____ If “yes” go to Part 3.

NO _____ If “no” attach a copy of the IRS tax return transcript (see directions above) and go to Part 3.

2.b. Even if the parent(s) did not file a tax return, did the parent(s) work at all or earn any income in 2015?

YES _____ If “yes” fill in the box below and attach all W2 forms.

NO _____ If “no” go to Part 3.

Name of employers in 2015

Total amount earned in 2015

Is W2 Attached?

1.

$

No

Yes

2.

$

No

3.

$

Yes

No

4.

$

Yes

No

1

1 2

2 3

3