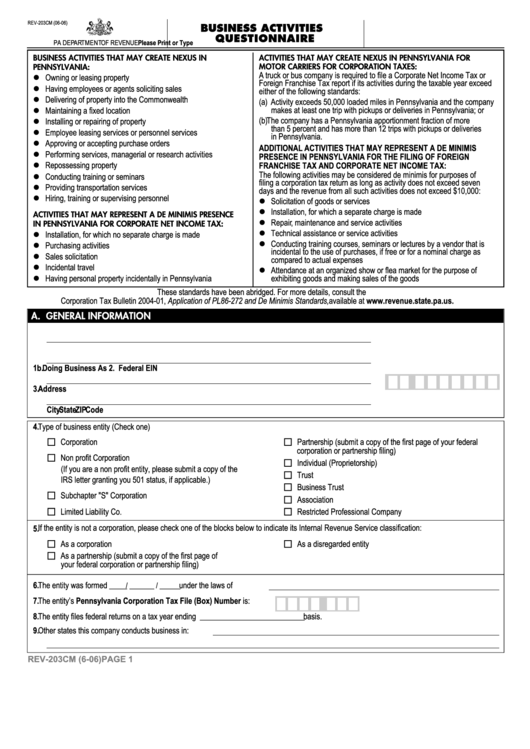

Form Rev-203cm - Business Activities Questionnaire

ADVERTISEMENT

R E V-203CM (06-06)

BUSINESS ACTIVITIES

Q U E S T I O N N A I R E

PA D E PA RT M E N T OF REVENUE

Please Print or Ty p e

BUSINESS ACTIVITIES THAT MAY CREATE NEXUS IN

ACTIVITIES THAT MAY CREATE NEXUS IN PENNSYLVANIA FOR

MOTOR CARRIERS FOR CORPORATION TAXES:

PENNSYLVANIA:

A truck or bus company is required to file a Corporate Net Income Tax or

Owning or leasing property

Foreign Franchise Tax report if its activities during the taxable year exceed

Having employees or agents soliciting sales

either of the following standards:

Delivering of property into the Commonwealth

(a) Activity exceeds 50,000 loaded miles in Pennsylvania and the company

makes at least one trip with pickups or deliveries in Pennsylvania; or

Maintaining a fixed location

( b ) The company has a Pennsylvania apportionment fraction of more

Installing or repairing of property

than 5 percent and has more than 12 trips with pickups or deliveries

Employee leasing services or personnel services

in Pennsylvania.

Approving or accepting purchase orders

ADDITIONAL ACTIVITIES THAT MAY REPRESENT A DE MINIMIS

Performing services, managerial or research activities

PRESENCE IN PENNSYLVANIA FOR THE FILING OF FOREIGN

Repossessing property

FRANCHISE TAX AND CORPORATE NET INCOME TAX:

The following activities may be considered de minimis for purposes of

Conducting training or seminars

filing a corporation tax return as long as activity does not exceed seven

Providing transportation services

days and the revenue from all such activities does not exceed $10,000:

Hiring, training or supervising personnel

Solicitation of goods or services

Installation, for which a separate charge is made

ACTIVITIES THAT MAY REPRESENT A DE MINIMIS PRESENCE

R e p a i r, maintenance and service activities

IN PENNSYLVANIA FOR CORPORATE NET INCOME TAX:

Technical assistance or service activities

Installation, for which no separate charge is made

Conducting training courses, seminars or lectures by a vendor that is

Purchasing activities

incidental to the use of purchases, if free or for a nominal charge as

Sales solicitation

compared to actual expenses

Incidental travel

Attendance at an organized show or flea market for the purpose of

Having personal property incidentally in Pennsylvania

exhibiting goods and making sales of the goods

These standards have been abridged. For more details, consult the

Corporation Tax Bulletin 2004-01, Application of PL 86-272 and De Minimis Standards, available at w w w. r e v e n u e . s t a t e . p a . u s .

A. GENERAL INFORMAT I O N

1a. Legal Name

1 b . Doing Business As

2. Federal EIN

3 . A d d r e s s

C i t y

S t a t e

Z I P C o d e

4 . Type of business entity (Check one)

C o r p o r a t i o n

Partnership (submit a copy of the first page of your federal

corporation or partnership filing)

Non profit Corporation

Individual (Proprietorship)

(If you are a non profit entity, please submit a copy of the

Tr u s t

IRS letter granting you 501 status, if applicable.)

Business Tr u s t

Subchapter "S" Corporation

A s s o c i a t i o n

Limited Liability Co.

Restricted Professional Company

5 . If the entity is not a corporation, please check one of the blocks below to indicate its Internal Revenue Service classification:

As a corporation

As a disregarded entity

As a partnership (submit a copy of the first page of

your federal corporation or partnership filing)

6 . The entity was formed

under the laws of

_ _ _ _ _ _ / _______ / _ _ _ _ _ _ _

7 . The entity’s Pennsylvania Corporation Tax File (Box) Number is:

8 . The entity files federal returns on a tax year ending _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ b a s i s .

9 . Other states this company conducts business in:

REV-203CM (6-06)

PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5