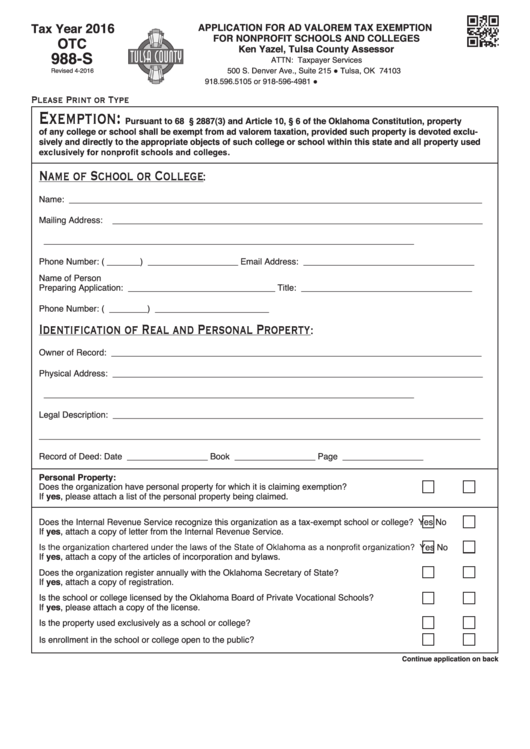

2018

Tax Year

APPLICATION FOR AD VALOREM TAX EXEMPTION

FOR NONPROFIT SCHOOLS AND COLLEGES

OTC

Ken Yazel, Tulsa County Assessor

988-S

ATTN: Taxpayer Services

500 S. Denver Ave., Suite 215 ● Tulsa, OK 74103

Revised 6-2017

918.596.5105 ●

Please Print or Type

Exemption

:

Pursuant to 68 O.S. § 2887(3) and Article 10, § 6 of the Oklahoma Constitution, property

of any college or school shall be exempt from ad valorem taxation, provided such property is devoted exclu-

sively and directly to the appropriate objects of such college or school within this state and all property used

exclusively for nonprofit schools and colleges.

Name of School or College

:

Name: _______________________________________________________________________________________

Mailing Address: ______________________________________________________________________________

______________________________________________________________________________

Phone Number: ( _______ ) ___________________ Email Address: ____________________________________

Name of Person

Preparing Application: _______________________________

Title: ____________________________________

Phone Number: ( ________ ) ________________________

Identification of Real and Personal Property

:

Owner of Record: ______________________________________________________________________________

Physical Address: ______________________________________________________________________________

______________________________________________________________________________

Legal Description: ______________________________________________________________________________

_____________________________________________________________________________________________

Record of Deed:

Date _________________

Book _________________

Page _________________

Personal Property:

Does the organization have personal property for which it is claiming exemption? .............................

Yes

No

If yes, please attach a list of the personal property being claimed.

Does the Internal Revenue Service recognize this organization as a tax-exempt school or college?

Yes

No

If yes, attach a copy of letter from the Internal Revenue Service.

Is the organization chartered under the laws of the State of Oklahoma as a nonprofit organization?

Yes

No

If yes, attach a copy of the articles of incorporation and bylaws.

Does the organization register annually with the Oklahoma Secretary of State? ................................

Yes

No

If yes, attach a copy of registration.

Is the school or college licensed by the Oklahoma Board of Private Vocational Schools? ..................

Yes

No

If yes, please attach a copy of the license.

Is the property used exclusively as a school or college?......................................................................

Yes

No

Is enrollment in the school or college open to the public? ....................................................................

Yes

No

Continue application on back

1

1 2

2