Sample Employer Letter For Social Security Number Application

ADVERTISEMENT

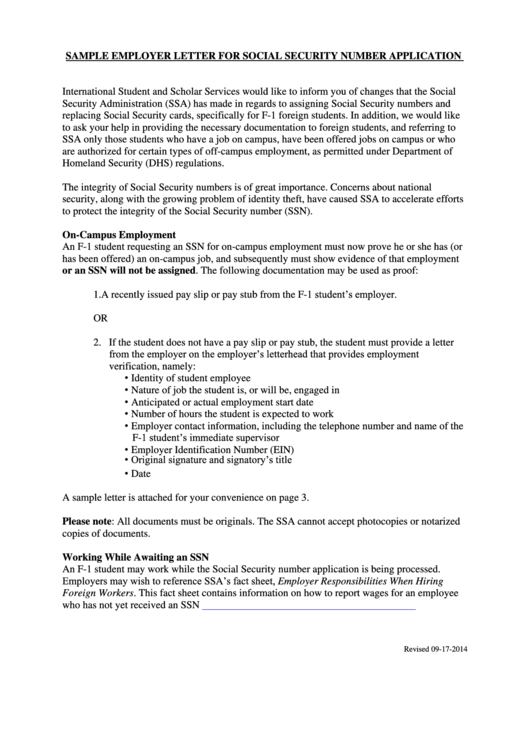

SAMPLE EMPLOYER LETTER FOR SOCIAL SECURITY NUMBER APPLICATION

International Student and Scholar Services would like to inform you of changes that the Social

Security Administration (SSA) has made in regards to assigning Social Security numbers and

replacing Social Security cards, specifically for F-1 foreign students. In addition, we would like

to ask your help in providing the necessary documentation to foreign students, and referring to

SSA only those students who have a job on campus, have been offered jobs on campus or who

are authorized for certain types of off-campus employment, as permitted under Department of

Homeland Security (DHS) regulations.

The integrity of Social Security numbers is of great importance. Concerns about national

security, along with the growing problem of identity theft, have caused SSA to accelerate efforts

to protect the integrity of the Social Security number (SSN).

On-Campus Employment

An F-1 student requesting an SSN for on-campus employment must now prove he or she has (or

has been offered) an on-campus job, and subsequently must show evidence of that employment

or an SSN will not be assigned. The following documentation may be used as proof:

1. A recently issued pay slip or pay stub from the F-1 student’s employer.

OR

2. If the student does not have a pay slip or pay stub, the student must provide a letter

from the employer on the employer’s letterhead that provides employment

verification, namely:

• Identity of student employee

• Nature of job the student is, or will be, engaged in

• Anticipated or actual employment start date

• Number of hours the student is expected to work

• Employer contact information, including the telephone number and name of the

F-1 student’s immediate supervisor

• Employer Identification Number (EIN)

• Original signature and signatory’s title

• Date

A sample letter is attached for your convenience on page 3.

Please note: All documents must be originals. The SSA cannot accept photocopies or notarized

copies of documents.

Working While Awaiting an SSN

An F-1 student may work while the Social Security number application is being processed.

Employers may wish to reference SSA’s fact sheet, Employer Responsibilities When Hiring

Foreign Workers. This fact sheet contains information on how to report wages for an employee

who has not yet received an SSN

Revised 09-17-2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3