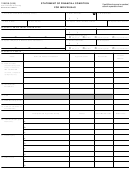

Statement Of Financial Condition For Individuals Form 2005

ADVERTISEMENT

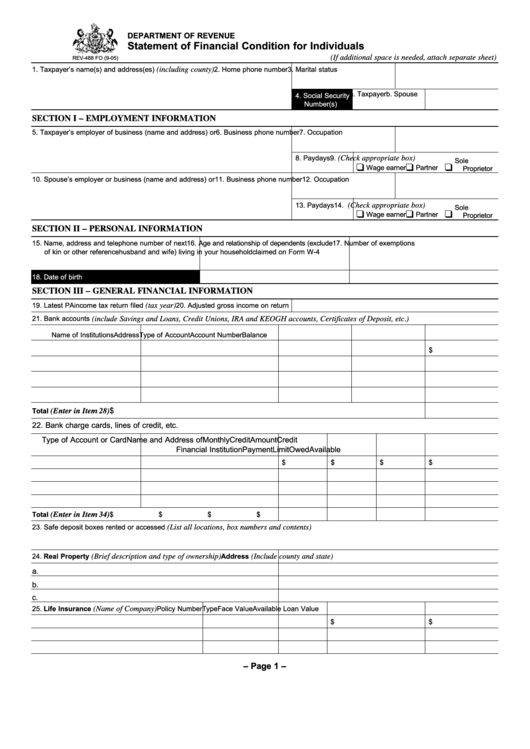

DEPARTMENT OF REVENUE

Statement of Financial Condition for Individuals

(If additional space is needed, attach separate sheet)

REV-488 FO (9-05)

(including county)

1. Taxpayer’s name(s) and address(es)

2. Home phone number

3. Marital status

a. Taxpayer

b. Spouse

4. Social Security

Number(s)

SECTION I – EMPLOYMENT INFORMATION

5. Taxpayer’s employer of business (name and address) or

6. Business phone number

7. Occupation

(Check appropriate box)

8. Paydays

9.

Sole

❑

❑

❑

Wage earner

Partner

Proprietor

10. Spouse’s employer or business (name and address) or

11. Business phone number

12. Occupation

(Check appropriate box)

13. Paydays

14.

Sole

❑

❑

❑

Wage earner

Partner

Proprietor

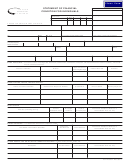

SECTION II – PERSONAL INFORMATION

15. Name, address and telephone number of next

16. Age and relationship of dependents (exclude 17. Number of exemptions

of kin or other reference

husband and wife) living in your household

claimed on Form W-4

18. Date of birth

a. Taxpayer

b. Spouse

SECTION III – GENERAL FINANCIAL INFORMATION

(tax year)

19. Latest PA income tax return filed

20. Adjusted gross income on return

(include Savings and Loans, Credit Unions, IRA and KEOGH accounts, Certificates of Deposit, etc.)

21. Bank accounts

Name of Institutions

Address

Type of Account

Account Number

Balance

$

(Enter in Item 28)

$

Total

22. Bank charge cards, lines of credit, etc.

Type of Account or Card

Name and Address of

Monthly

Credit

Amount

Credit

Financial Institution

Payment

Limit

Owed

Available

$

$

$

$

(Enter in Item 34)

Total

$

$

$

$

(List all locations, box numbers and contents)

23. Safe deposit boxes rented or accessed

(Brief description and type of ownership)

(Include county and state)

24. Real Property

Address

a.

b.

c.

(Name of Company)

25. Life Insurance

Policy Number

Type

Face Value

Available Loan Value

$

$

– Page 1 –

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3