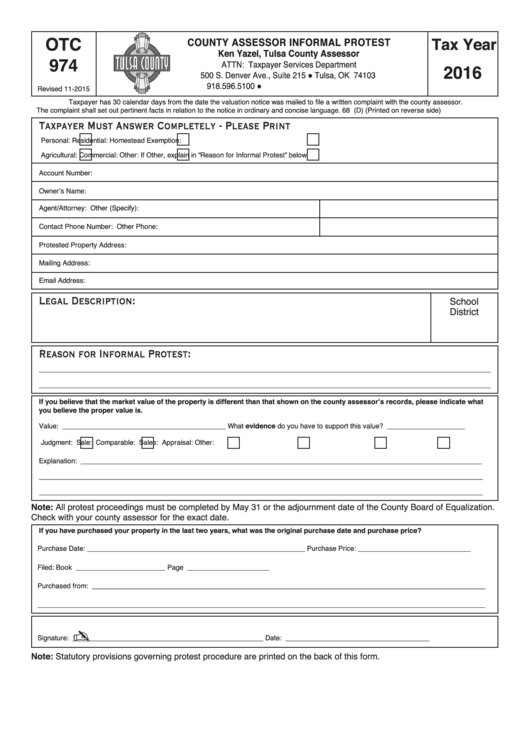

OTC

Tax Year

COUNTY ASSESSOR INFORMAL PROTEST

Ken Yazel, Tulsa County Assessor

974

ATTN: Taxpayer Services Department

2016

500 S. Denver Ave., Suite 215 ● Tulsa, OK 74103

918.596.5100 ●

Revised 11-2015

Taxpayer has 30 calendar days from the date the valuation notice was mailed to file a written complaint with the county assessor.

The complaint shall set out pertinent facts in relation to the notice in ordinary and concise language. 68 O.S. Section 2876(D) (Printed on reverse side)

Taxpayer Must Answer Completely - Please Print

Personal:

Residential:

Homestead Exemption:

Agricultural:

Commercial:

Other:

If Other, explain in “Reason for Informal Protest” below.

Account Number:

Owner’s Name:

Agent/Attorney:

Other (Specify):

Contact Phone Number:

Other Phone:

Protested Property Address:

Mailing Address:

Email Address:

Legal Description:

School

District

Reason for Informal Protest:

If you believe that the market value of the property is different than that shown on the county assessor’s records, please indicate what

you believe the proper value is.

Value: __________________________________________

What evidence do you have to support this value? ____________________

Judgment:

Sale:

Comparable:

Sales:

Appraisal:

Other:

Explanation: _______________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

Note: All protest proceedings must be completed by May 31 or the adjournment date of the County Board of Equalization.

Check with your county assessor for the exact date.

If you have purchased your property in the last two years, what was the original purchase date and purchase price?

Purchase Date: ________________________________________________________

Purchase Price: _____________________________

Filed: Book _______________________

Page _____________________

Purchased from: _____________________________________________________________________________________________________

___________________________________________________________________________________________________________________

✍

Signature:

_________________________________________________

Date: _____________________________________

Note: Statutory provisions governing protest procedure are printed on the back of this form.

1

1 2

2