Cfa Credit Reference Form

ADVERTISEMENT

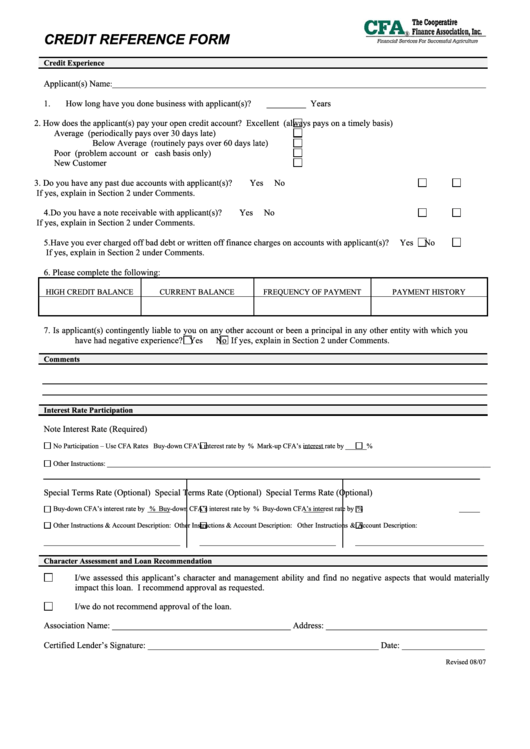

CREDIT REFERENCE FORM

Credit Experience

Applicant(s) Name

:________________________________________________________________________________________________

1.

How long have you done business with applicant(s)?

_________ Years

2.

How does the applicant(s) pay your open credit account?

Excellent (always pays on a timely basis)

Average (periodically pays over 30 days late)

Below Average (routinely pays over 60 days late)

Poor (problem account or cash basis only)

New Customer

3.

Do you have any past due accounts with applicant(s)?

Yes

No

If yes, explain in Section 2 under Comments.

4.

Do you have a note receivable with applicant(s)?

Yes

No

If yes, explain in Section 2 under Comments.

5.

Have you ever charged off bad debt or written off finance charges on accounts with applicant(s)?

Yes

No

If yes, explain in Section 2 under Comments.

6.

Please complete the following:

HIGH CREDIT BALANCE

CURRENT BALANCE

FREQUENCY OF PAYMENT

PAYMENT HISTORY

7.

Is applicant(s) contingently liable to you on any other account or been a principal in any other entity with which you

have had negative experience?

Yes

No

If yes, explain in Section 2 under Comments.

Comments

Interest Rate Participation

Note Interest Rate (Required)

No Participation – Use CFA Rates

Buy-down CFA’s interest rate by

%

Mark-up CFA’s interest rate by ______%

Other Instructions: ____________________________________________________________________________________________________________

Special Terms Rate (Optional)

Special Terms Rate (Optional)

Special Terms Rate (Optional)

Buy-down CFA’s interest rate by

%

Buy-down CFA’s interest rate by

%

Buy-down CFA’s interest rate by

%

Other Instructions & Account Description:

Other Instructions & Account Description:

Other Instructions & Account Description:

___________________________________

___________________________________

_________________________________

Character Assessment and Loan Recommendation

I/we assessed this applicant’s character and management ability and find no negative aspects that would materially

impact this loan. I recommend approval as requested.

I/we do not recommend approval of the loan.

Association Name: _________________________________________ Address: _____________________________________

Certified Lender’s Signature: _____________________________________________________ Date: ___________________

Revised 08/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1