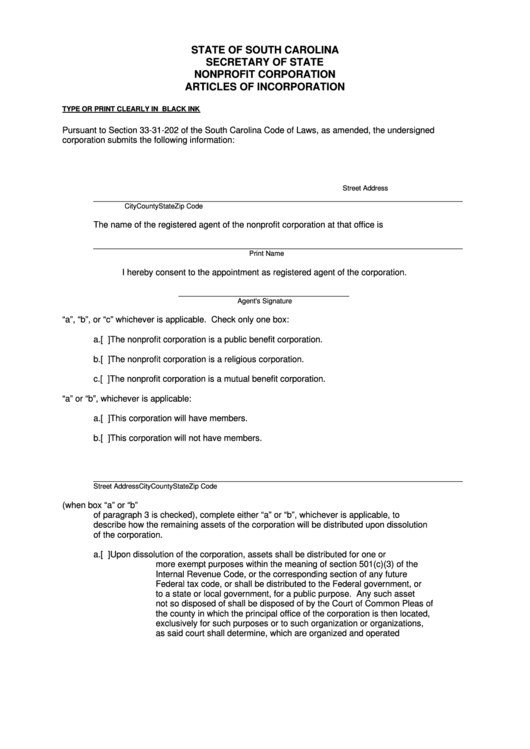

STATE OF SOUTH CAROLINA

SECRETARY OF STATE

NONPROFIT CORPORATION

ARTICLES OF INCORPORATION

TYPE OR PRINT CLEARLY IN BLACK INK

Pursuant to Section 33-31-202 of the South Carolina Code of Laws, as amended, the undersigned

corporation submits the following information:

1.

The name of the nonprofit corporation is _____________________________________________

2.

The initial registered office of the nonprofit corporation is ________________________________

Street Address

______________________________________________________________________________

City

County

State

Zip Code

The name of the registered agent of the nonprofit corporation at that office is

______________________________________________________________________________

Print Name

I hereby consent to the appointment as registered agent of the corporation.

____________________________________

Agent's Signature

3.

Check “a”, “b”, or “c” whichever is applicable. Check only one box:

a.

[ ]

The nonprofit corporation is a public benefit corporation.

b.

[ ]

The nonprofit corporation is a religious corporation.

c.

[ ]

The nonprofit corporation is a mutual benefit corporation.

4.

Check “a” or “b”, whichever is applicable:

a.

[ ]

This corporation will have members.

b.

[ ]

This corporation will not have members.

5.

The address of the principal office of the nonprofit corporation is

______________________________________________________________________________

Street Address

City

County

State

Zip Code

6.

If this nonprofit corporation is either a public benefit or religious corporation (when box “a” or “b”

of paragraph 3 is checked), complete either “a” or “b”, whichever is applicable, to

describe how the remaining assets of the corporation will be distributed upon dissolution

of the corporation.

a.

[ ]

Upon dissolution of the corporation, assets shall be distributed for one or

more exempt purposes within the meaning of section 501(c)(3) of the

Internal Revenue Code, or the corresponding section of any future

Federal tax code, or shall be distributed to the Federal government, or

to a state or local government, for a public purpose. Any such asset

not so disposed of shall be disposed of by the Court of Common Pleas of

the county in which the principal office of the corporation is then located,

exclusively for such purposes or to such organization or organizations,

as said court shall determine, which are organized and operated

1

1 2

2