Form Rev 86 0059 - Leasehold Excise Tax Return Federal Permit Or Lease - 2007

ADVERTISEMENT

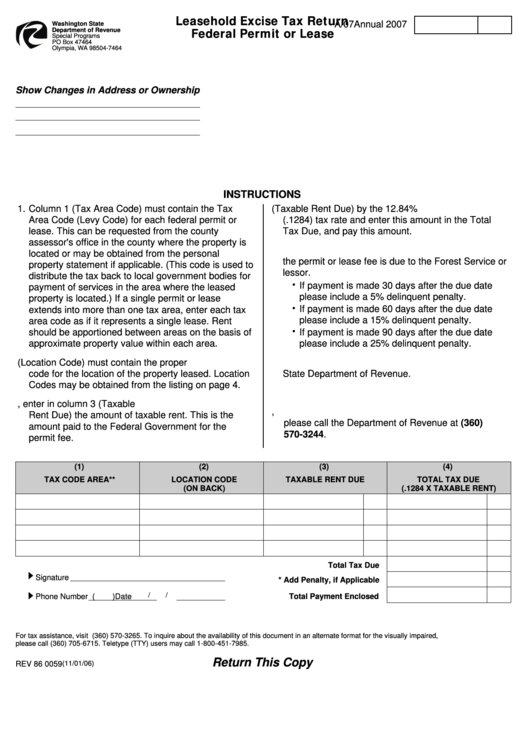

Leasehold Excise Tax Return

Annual 2007

A/07

Washington State

Federal Permit or Lease

Department of Revenue

Special Programs

PO Box 47464

Olympia, WA 98504-7464

Show Changes in Address or Ownership

INSTRUCTIONS

1.

Column 1 (Tax Area Code) must contain the Tax

4. Multiply column 3 (Taxable Rent Due) by the 12.84%

Area Code (Levy Code) for each federal permit or

(.1284) tax rate and enter this amount in the Total

lease. This can be requested from the county

Tax Due, and pay this amount.

assessor's office in the county where the property is

5. Leasehold Excise Tax returns are due 15 days after

located or may be obtained from the personal

the permit or lease fee is due to the Forest Service or

property statement if applicable. (This code is used to

lessor.

distribute the tax back to local government bodies for

If payment is made 30 days after the due date

payment of services in the area where the leased

please include a 5% delinquent penalty.

property is located.) If a single permit or lease

If payment is made 60 days after the due date

extends into more than one tax area, enter each tax

please include a 15% delinquent penalty.

area code as if it represents a single lease. Rent

should be apportioned between areas on the basis of

If payment is made 90 days after the due date

approximate property value within each area.

please include a 25% delinquent penalty.

2. Column 2 (Location Code) must contain the proper

6. Attach remittance made payable to the Washington

code for the location of the property leased. Location

State Department of Revenue.

Codes may be obtained from the listing on page 4.

7. Sign and date page 1.

3. For each permit or lease, enter in column 3 (Taxable

8. Should you have questions regarding your tax liability,

Rent Due) the amount of taxable rent. This is the

please call the Department of Revenue at (360)

amount paid to the Federal Government for the

570-3244.

permit fee.

(1)

(2)

(3)

(4)

TAX CODE AREA**

LOCATION CODE

TAXABLE RENT DUE

TOTAL TAX DUE

(ON BACK)

(.1284 X TAXABLE RENT)

Total Tax Due

Signature

* Add Penalty, if Applicable

/

/

Phone Number (

)

Date

Total Payment Enclosed

For tax assistance, visit or call (360) 570-3265. To inquire about the availability of this document in an alternate format for the visually impaired,

please call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

Return This Copy

(11/01/06)

REV 86 0059

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4