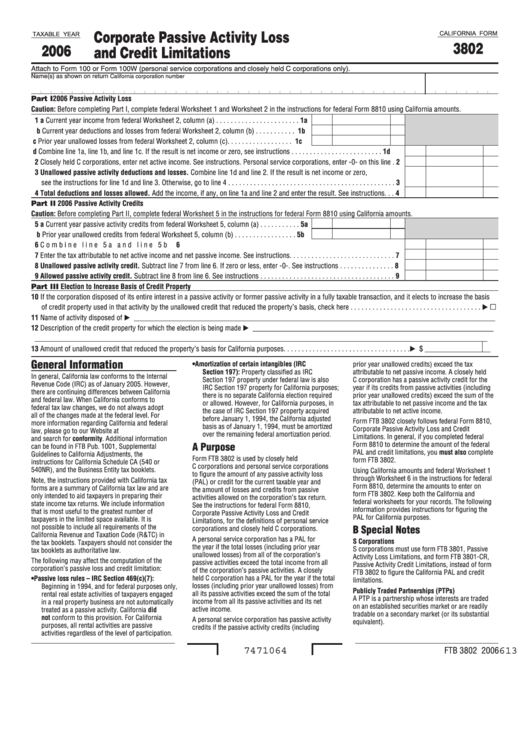

California Form 3802 - Corporate Passive Activity Loss And Credit Limitations - 2006

ADVERTISEMENT

Corporate Passive Activity Loss

CALIFORNIA FORM

TAXABLE YEAR

3802

2006

and Credit Limitations

Attach to Form 100 or Form 100W (personal service corporations and closely held C corporations only).

Name(s) as shown on return

California corporation number

Part I 2006 Passive Activity Loss

Caution: Before completing Part I, complete federal Worksheet 1 and Worksheet 2 in the instructions for federal Form 8810 using California amounts.

1 a Current year income from federal Worksheet 2, column (a) . . . . . . . . . . . . . . . . . . . . . . .

1a

b Current year deductions and losses from federal Worksheet 2, column (b) . . . . . . . . . . .

1b

c Prior year unallowed losses from federal Worksheet 2, column (c). . . . . . . . . . . . . . . . . .

1c

d Combine line 1a, line 1b, and line 1c. If the result is net income or zero, see instructions . . . . . . . . . . . . . . . . . . . . . . . . .

1d

2 Closely held C corporations, enter net active income. See instructions. Personal service corporations, enter -0- on this line .

2

3 Unallowed passive activity deductions and losses. Combine line 1d and line 2. If the result is net income or zero,

see the instructions for line 1d and line 3. Otherwise, go to line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Total deductions and losses allowed. Add the income, if any, on line 1a and line 2 and enter the result. See instructions. . .

4

Part II 2006 Passive Activity Credits

Caution: Before completing Part II, complete federal Worksheet 5 in the instructions for federal Form 8810 using California amounts.

5 a Current year passive activity credits from federal Worksheet 5, column (a) . . . . . . . . . . .

5a

b Prior year unallowed credits from federal Worksheet 5, column (b) . . . . . . . . . . . . . . . . .

5b

6 Combine line 5a and line 5b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Enter the tax attributable to net active income and net passive income. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Unallowed passive activity credit. Subtract line 7 from line 6. If zero or less, enter -0-. See instructions . . . . . . . . . . . . . . .

8

9 Allowed passive activity credit. Subtract line 8 from line 6. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Part III Election to Increase Basis of Credit Property

10 If the corporation disposed of its entire interest in a passive activity or former passive activity in a fully taxable transaction, and it elects to increase the basis

of credit property used in that activity by the unallowed credit that reduced the property’s basis, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Name of activity disposed of ___________________________________________________________________________________________________

12 Description of the credit property for which the election is being made __________________________________________________________________

____________________________________________________________________________________________________________________________

13 Amount of unallowed credit that reduced the property’s basis for California purposes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ __________________

General Information

prior year unallowed credits) exceed the tax

•

Amortization of certain intangibles (IRC

Section 197): Property classified as IRC

attributable to net passive income. A closely held

In general, California law conforms to the Internal

C corporation has a passive activity credit for the

Section 197 property under federal law is also

Revenue Code (IRC) as of January 2005. However,

IRC Section 197 property for California purposes;

year if its credits from passive activities (including

there are continuing differences between California

prior year unallowed credits) exceed the sum of the

there is no separate California election required

and federal law. When California conforms to

or allowed. However, for California purposes, in

tax attributable to net passive income and the tax

federal tax law changes, we do not always adopt

the case of IRC Section 197 property acquired

attributable to net active income.

all of the changes made at the federal level. For

before January 1, 1994, the California adjusted

Form FTB 3802 closely follows federal Form 8810,

more information regarding California and federal

basis as of January 1, 1994, must be amortized

Corporate Passive Activity Loss and Credit

law, please go to our Website at

over the remaining federal amortization period.

Limitations. In general, if you completed federal

and search for conformity. Additional information

A Purpose

Form 8810 to determine the amount of the federal

can be found in FTB Pub. 1001, Supplemental

PAL and credit limitations, you must also complete

Guidelines to California Adjustments, the

Form FTB 3802 is used by closely held

form FTB 3802.

instructions for California Schedule CA (540 or

C corporations and personal service corporations

540NR), and the Business Entity tax booklets.

Using California amounts and federal Worksheet 1

to figure the amount of any passive activity loss

through Worksheet 6 in the instructions for federal

Note, the instructions provided with California tax

(PAL) or credit for the current taxable year and

Form 8810, determine the amounts to enter on

forms are a summary of California tax law and are

the amount of losses and credits from passive

form FTB 3802. Keep both the California and

only intended to aid taxpayers in preparing their

activities allowed on the corporation’s tax return.

federal worksheets for your records. The following

state income tax returns. We include information

See the instructions for federal Form 8810,

information provides instructions for figuring the

that is most useful to the greatest number of

Corporate Passive Activity Loss and Credit

PAL for California purposes.

taxpayers in the limited space available. It is

Limitations, for the definitions of personal service

not possible to include all requirements of the

B Special Notes

corporations and closely held C corporations.

California Revenue and Taxation Code (R&TC) in

A personal service corporation has a PAL for

S Corporations

the tax booklets. Taxpayers should not consider the

the year if the total losses (including prior year

S corporations must use form FTB 3801, Passive

tax booklets as authoritative law.

unallowed losses) from all of the corporation’s

Activity Loss Limitations, and form FTB 3801-CR,

The following may affect the computation of the

passive activities exceed the total income from all

Passive Activity Credit Limitations, instead of form

corporation’s passive loss and credit limitation:

of the corporation’s passive activities. A closely

FTB 3802 to figure the California PAL and credit

held C corporation has a PAL for the year if the total

•

Passive loss rules – IRC Section 469(c)(7):

limitations.

losses (including prior year unallowed losses) from

Beginning in 1994, and for federal purposes only,

Publicly Traded Partnerships (PTPs)

all its passive activities exceed the sum of the total

rental real estate activities of taxpayers engaged

A PTP is a partnership whose interests are traded

income from all its passive activities and its net

in a real property business are not automatically

on an established securities market or are readily

active income.

treated as a passive activity. California did

tradable on a secondary market (or its substantial

not conform to this provision. For California

A personal service corporation has passive activity

equivalent).

purposes, all rental activities are passive

credits if the passive activity credits (including

activities regardless of the level of participation.

FTB 3802 2006

613

7471064

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1