Print and Reset Form

Reset Form

YEAR

CALIFORNIA FORM

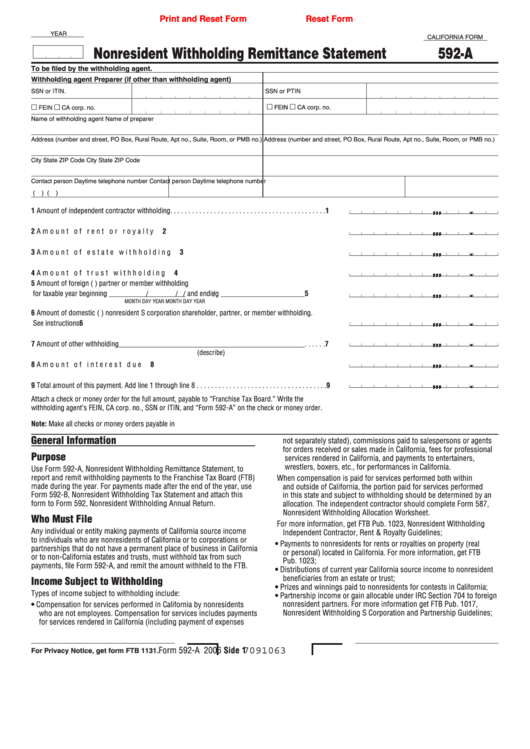

Nonresident Withholding Remittance Statement

592-A

To be filed by the withholding agent.

Withholding agent

Preparer (if other than withholding agent)

SSN or ITIN.

SSN or PTIN

FEIN

CA corp. no.

FEIN

CA corp. no.

Name of withholding agent

Name of preparer

Address (number and street, PO Box, Rural Route, Apt no., Suite, Room, or PMB no.) Address (number and street, PO Box, Rural Route, Apt no., Suite, Room, or PMB no.)

City

State

ZIP Code

City

State

ZIP Code

Contact person

Daytime telephone number

Contact person

Daytime telephone number

(

)

(

)

.

,

,

,

� Amount of independent contractor withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �

.

,

,

,

,

,

,

2 Amount of rent or royalty withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.

,

,

,

,

,

,

3 Amount of estate withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.

,

,

,

,

,

,

4 Amount of trust withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Amount of foreign (non-U .S .) partner or member withholding

.

,

,

,

,

,

,

for taxable year beginning _____________________ and ending _______________________ . . . . . 5

/

/

/

/

MONTH

DAY

YEAR

MONTH

DAY

YEAR

6 Amount of domestic (U .S .) nonresident S corporation shareholder, partner, or member withholding .

.

,

,

,

,

,

,

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

.

,

,

,

,

,

,

7 Amount of other withholding___________________________________________________ . . . . . . 7

(describe)

.

,

,

,

,

,

,

8 Amount of interest due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

.

,

,

,

,

,

,

9 Total amount of this payment . Add line 1 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Attach a check or money order for the full amount, payable to “Franchise Tax Board .” Write the

withholding agent’s FEIN, CA corp . no ., SSN or ITIN, and “Form 592-A” on the check or money order .

Note: Make all checks or money orders payable in U .S . dollars and drawn against a U .S . financial institution .

General Information

not separately stated), commissions paid to salespersons or agents

for orders received or sales made in California, fees for professional

Purpose

services rendered in California, and payments to entertainers,

wrestlers, boxers, etc ., for performances in California .

Use Form 592-A, Nonresident Withholding Remittance Statement, to

report and remit withholding payments to the Franchise Tax Board (FTB)

When compensation is paid for services performed both within

made during the year . For payments made after the end of the year, use

and outside of California, the portion paid for services performed

Form 592-B, Nonresident Withholding Tax Statement and attach this

in this state and subject to withholding should be determined by an

form to Form 592, Nonresident Withholding Annual Return .

allocation . The independent contractor should complete Form 587,

Nonresident Withholding Allocation Worksheet .

Who Must File

For more information, get FTB Pub . 1023, Nonresident Withholding

Any individual or entity making payments of California source income

Independent Contractor, Rent & Royalty Guidelines;

to individuals who are nonresidents of California or to corporations or

• Payments to nonresidents for rents or royalties on property (real

partnerships that do not have a permanent place of business in California

or personal) located in California . For more information, get FTB

or to non-California estates and trusts, must withhold tax from such

Pub . 1023;

payments, file Form 592-A, and remit the amount withheld to the FTB .

• Distributions of current year California source income to nonresident

beneficiaries from an estate or trust;

Income Subject to Withholding

• Prizes and winnings paid to nonresidents for contests in California;

Types of income subject to withholding include:

• Partnership income or gain allocable under IRC Section 704 to foreign

• Compensation for services performed in California by nonresidents

nonresident partners . For more information get FTB Pub . 1017,

who are not employees . Compensation for services includes payments

Nonresident Withholding S Corporation and Partnership Guidelines;

for services rendered in California (including payment of expenses

7091063

Form 592-A 2006 Side �

For Privacy Notice, get form FTB 1131.

1

1