Form 480.80 - Fiduciary Income Tax Return (Estate Or Trust)

ADVERTISEMENT

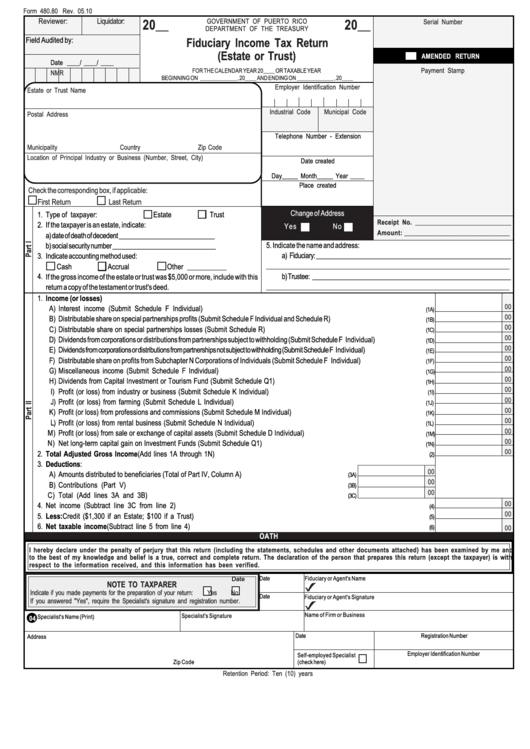

Form 480.80 Rev. 05.10

Reviewer:

Liquidator:

20__

GOVERNMENT OF PUERTO RICO

20__

Serial Number

DEPARTMENT OF THE TREASURY

Field Audited by:

Fiduciary Income Tax Return

(Estate or Trust)

AMENDED RETURN

Date ____/ ____/ ____

Payment Stamp

FOR THE CALENDAR YEAR 20____ OR TAXABLE YEAR

R

M

N

BEGINNING ON _____________ , 20____ AND ENDING ON _____________ , 20____

Employer Identification Number

Estate or Trust Name

Industrial Code

Municipal Code

Postal Address

Telephone Number - Extension

Municipality

Country

Zip Code

Location of Principal Industry or Business (Number, Street, City)

Date created

Day_____ Month_____ Year

_____

Place created

Check the corresponding box, if applicable:

6

First Return

Last Return

Change of Address

1.

Type of taxpayer:

Estate

Trust

Receipt No. _____________________________

2.

If the taxpayer is an estate, indicate:

Yes

No

Amount:

_______________________________

a) date of death of decedent ____________________________

5. Indicate the name and address:

b) social security number ______________________________

a) Fiduciary: __________________________________________________________

3.

Indicate accounting method used:

____________________________________________________________________________

Cash

Accrual

Other ___________

4.

b) Trustee: ___________________________________________________________

If the gross income of the estate or trust was $5,000 or more, include with this

____________________________________________________________________________

return a copy of the testament or trust's deed.

1.

Income (or losses)

00

A)

Interest income (Submit Schedule F Individual) ....................................................................................................................

(1A)

00

B)

Distributable share on special partnerships profits (Submit Schedule F Individual and Schedule R) ................................................

(1B)

00

C)

Distributable share on special partnerships losses (Submit Schedule R) ...................................................................................

(1C)

00

D)

Dividends from corporations or distributions from partnerships subject to withholding (Submit Schedule F Individual) ........................

(1D)

00

E)

Dividends from corporations or distributions from partnerships not subject to withholding (Submit Schedule F Individual) ..............................

(1E)

00

F)

Distributable share on profits from Subchapter N Corporations of Individuals (Submit Schedule F Individual) ................................

(1F)

00

G)

Miscellaneous income (Submit Schedule F Individual) ............................................................................................................

(1G)

00

H)

Dividends from Capital Investment or Tourism Fund (Submit Schedule Q1) ..............................................................................

(1H)

00

I)

Profit (or loss) from industry or business (Submit Schedule K Individual) .................................................................................

(1I)

00

J)

Profit (or loss) from farming (Submit Schedule L Individual) ....................................................................................................

(1J)

00

K)

Profit (or loss) from professions and commissions (Submit Schedule M Individual) .....................................................................

(1K)

00

L)

Profit (or loss) from rental business (Submit Schedule N Individual) .........................................................................................

(1L)

00

M)

Profit (or loss) from sale or exchange of capital assets (Submit Schedule D Individual) ..............................................................

(1M)

00

N)

Net long-term capital gain on Investment Funds (Submit Schedule Q1) .....................................................................................

(1N)

00

2.

Total Adjusted Gross Income (Add lines 1A through 1N) .............................................................................................................

(2)

3.

Deductions:

00

A)

Amounts distributed to beneficiaries (Total of Part IV, Column A) ......................................................

(3A)

00

B)

Contributions (Part V) ................................................................................................................

(3B)

00

C)

Total (Add lines 3A and 3B) .......................................................................................................

(3C)

00

4.

Net income (Subtract line 3C from line 2) ...................................................................................................................................

(4)

00

5.

Less: Credit ($1,300 if an Estate; $100 if a Trust) ........................................................................................................................

(5)

6.

Net taxable income (Subtract line 5 from line 4) ..........................................................................................................................

(6)

00

OATH

I hereby declare under the penalty of perjury that this return (including the statements, schedules and other documents attached) has been examined by me and

to the best of my knowledge and belief is a true, correct and complete return. The declaration of the person that prepares this return (except the taxpayer) is with

respect to the information received, and this information has been verified.

Date

Fiduciary or Agent's Name

Date

NOTE TO TAXPARER

x

Indicate if you made payments for the preparation of your return:

Yes

No.

Date

Fiduciary or Agent's Signature

If you answered "Yes", require the Specialist's signature and registration number.

x

Name of Firm or Business

Specialist's Signature

Specialist's Name (Print)

04

Date

Registration Number

Address

Employer Identification Number

Self-employed Specialist

Zip Code

(check here)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2