Form # 221- Application To Participate In The Teacher Deferred Retirement Option Plan Form

ADVERTISEMENT

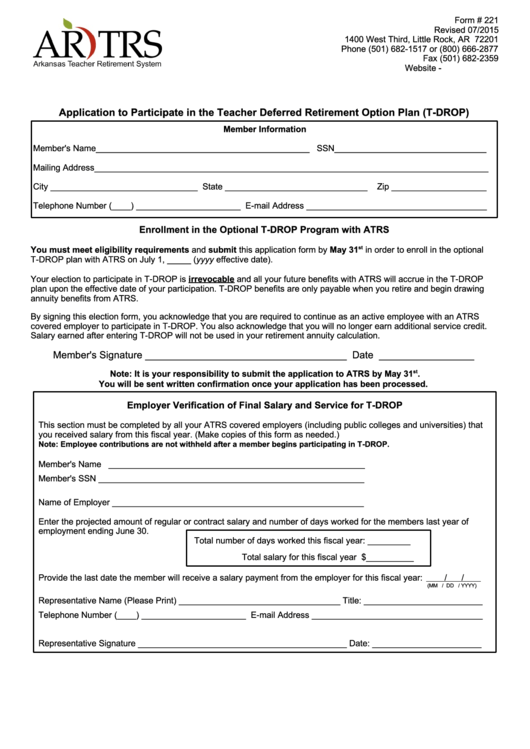

Form # 221

Revised 07/2015

1400 West Third, Little Rock, AR 72201

Phone (501) 682-1517 or (800) 666-2877

Fax (501) 682-2359

Website -

Application to Participate in the Teacher Deferred Retirement Option Plan (T-DROP)

Member Information

Member's Name_____________________________________________ SSN________________________________

Mailing Address___________________________________________________________________________________

City _______________________________ State ______________________________

Zip ____________________

Telephone Number (____) ______________________ E-mail Address ______________________________________

Enrollment in the Optional T-DROP Program with ATRS

st

You must meet eligibility requirements and submit this application form by May 31

in order to enroll in the optional

T-DROP plan with ATRS on July 1, _____ (yyyy effective date).

Your election to participate in T-DROP is irrevocable and all your future benefits with ATRS will accrue in the T-DROP

plan upon the effective date of your participation. T-DROP benefits are only payable when you retire and begin drawing

annuity benefits from ATRS.

By signing this election form, you acknowledge that you are required to continue as an active employee with an ATRS

covered employer to participate in T-DROP. You also acknowledge that you will no longer earn additional service credit.

Salary earned after entering T-DROP will not be used in your retirement annuity calculation.

Member's Signature ____________________________________ Date _________________

Note: It is your responsibility to submit the application to ATRS by May 31

st

.

You will be sent written confirmation once your application has been processed.

Employer Verification of Final Salary and Service for T-DROP

This section must be completed by all your ATRS covered employers (including public colleges and universities) that

you received salary from this fiscal year. (Make copies of this form as needed.)

Note: Employee contributions are not withheld after a member begins participating in T-DROP.

Member's Name ______________________________________________________

Member's SSN ________________________________________________________

Name of Employer _____________________________________________________

Enter the projected amount of regular or contract salary and number of days worked for the members last year of

employment ending June 30.

Total number of days worked this fiscal year: _________

Total salary for this fiscal year $__________

Provide the last date the member will receive a salary payment from the employer for this fiscal year:

/

/

(MM / DD / YYYY)

Representative Name (Please Print) __________________________________ Title: _________________________

Telephone Number (____) ______________________ E-mail Address ____________________________________

Representative Signature ____________________________________________ Date: _______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1