Qualified Domestic Relations Order - State Of Louisiana District Court

ADVERTISEMENT

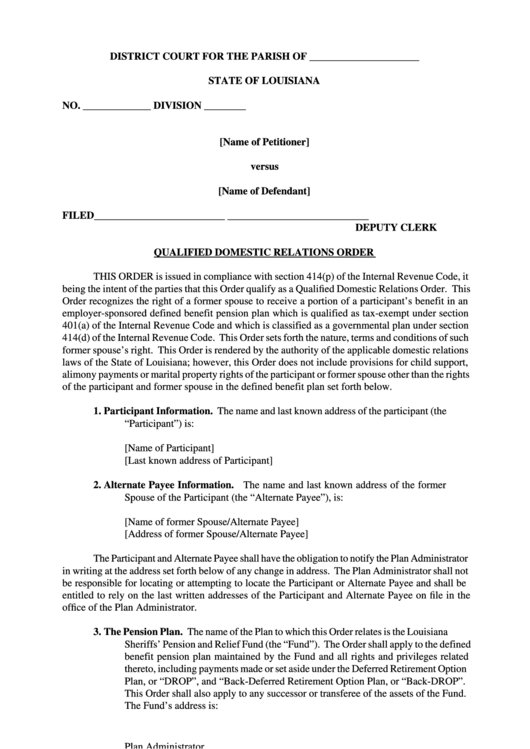

DISTRICT COURT FOR THE PARISH OF _____________________

STATE OF LOUISIANA

NO. _____________

DIVISION ________

[Name of Petitioner]

versus

[Name of Defendant]

FILED_________________________

___________________________

DEPUTY CLERK

QUALIFIED DOMESTIC RELATIONS ORDER

THIS ORDER is issued in compliance with section 414(p) of the Internal Revenue Code, it

being the intent of the parties that this Order qualify as a Qualified Domestic Relations Order. This

Order recognizes the right of a former spouse to receive a portion of a participant’s benefit in an

employer-sponsored defined benefit pension plan which is qualified as tax-exempt under section

401(a) of the Internal Revenue Code and which is classified as a governmental plan under section

414(d) of the Internal Revenue Code. This Order sets forth the nature, terms and conditions of such

former spouse’s right. This Order is rendered by the authority of the applicable domestic relations

laws of the State of Louisiana; however, this Order does not include provisions for child support,

alimony payments or marital property rights of the participant or former spouse other than the rights

of the participant and former spouse in the defined benefit plan set forth below.

1.

Participant Information. The name and last known address of the participant (the

“Participant”) is:

[Name of Participant]

[Last known address of Participant]

2.

Alternate Payee Information. The name and last known address of the former

Spouse of the Participant (the “Alternate Payee”), is:

[Name of former Spouse/Alternate Payee]

[Address of former Spouse/Alternate Payee]

The Participant and Alternate Payee shall have the obligation to notify the Plan Administrator

in writing at the address set forth below of any change in address. The Plan Administrator shall not

be responsible for locating or attempting to locate the Participant or Alternate Payee and shall be

entitled to rely on the last written addresses of the Participant and Alternate Payee on file in the

office of the Plan Administrator.

3.

The Pension Plan. The name of the Plan to which this Order relates is the Louisiana

Sheriffs’ Pension and Relief Fund (the “Fund”). The Order shall apply to the defined

benefit pension plan maintained by the Fund and all rights and privileges related

thereto, including payments made or set aside under the Deferred Retirement Option

Plan, or “DROP”, and “Back-Deferred Retirement Option Plan, or “Back-DROP”.

This Order shall also apply to any successor or transferee of the assets of the Fund.

The Fund’s address is:

Plan Administrator

Louisiana Sheriffs’ Pension and Relief Fund

1225 Nicholson Drive

Baton Rouge, Louisiana 70802-7537

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3