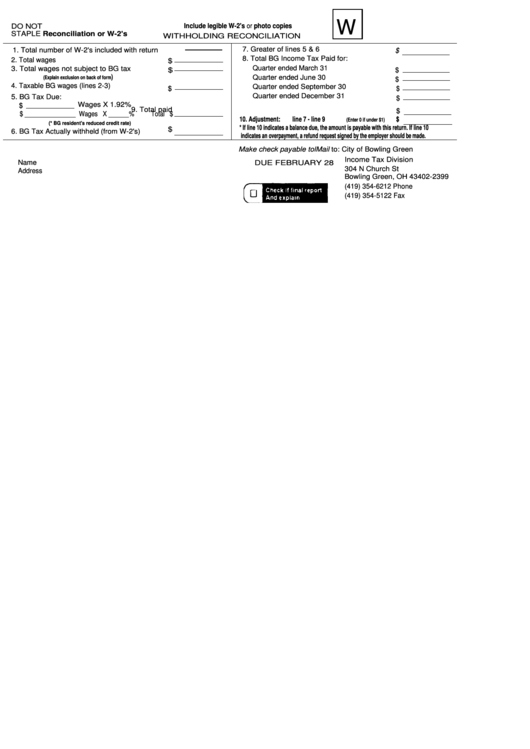

Form W-2 - Withholding Reconciliation

ADVERTISEMENT

W

Include legible W-2's or photo copies

DO NOT

STAPLE Reconciliation or W-2's

WITHHOLDING RECONCILIATION

7. Greater of lines 5 & 6

1. Total number of W-2's included with return

$

8. Total BG Income Tax Paid for:

2. Total wages

$

Quarter ended March 31

3. Total wages not subject to BG tax

$

$

)

Quarter ended June 30

(Explain exclusion on back of form

$

4. Taxable BG wages (lines 2-3)

Quarter ended September 30

$

$

Quarter ended December 31

5. BG Tax Due:

$

Wages X 1.92%

$

9. Total paid

$

$ _______________ Wages X ______%

Total $

10. Adjustment:

line 7 - line 9

$

(Enter 0 if under $1)

(* BG resident's reduced credit rate)

* If line 10 indicates a balance due, the amount is payable with this return. If line 10

$

6. BG Tax Actually withheld (from W-2's)

indicates an overpayment, a refund request signed by the employer should be made.

Make check payable tolMail to: City of Bowling Green

Income Tax Division

Name

DUE FEBRUARY 28

304 N Church St

Address

Bowling Green, OH 43402-2399

(419) 354-6212 Phone

(419) 354-5122 Fax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1