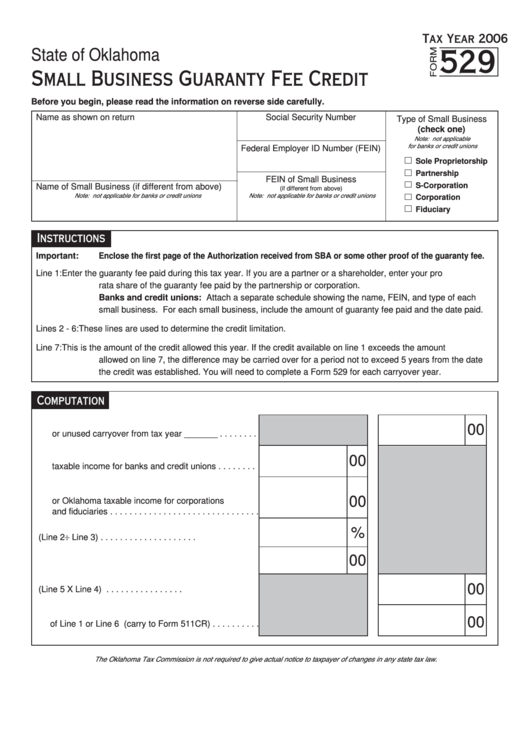

Tax Year 2006

State of Oklahoma

529

Small Business Guaranty Fee Credit

Before you begin, please read the information on reverse side carefully.

Name as shown on return

Social Security Number

Type of Small Business

(check one)

Note: not applicable

for banks or credit unions

Federal Employer ID Number (FEIN)

Sole Proprietorship

Partnership

FEIN of Small Business

S-Corporation

Name of Small Business (if different from above)

(if different from above)

Note: not applicable for banks or credit unions

Note: not applicable for banks or credit unions

Corporation

Fiduciary

Instructions

Important:

Enclose the first page of the Authorization received from SBA or some other proof of the guaranty fee.

Line 1:

Enter the guaranty fee paid during this tax year. If you are a partner or a shareholder, enter your pro

rata share of the guaranty fee paid by the partnership or corporation.

Banks and credit unions: Attach a separate schedule showing the name, FEIN, and type of each

small business. For each small business, include the amount of guaranty fee paid and the date paid.

Lines 2 - 6:

These lines are used to determine the credit limitation.

Line 7:

This is the amount of the credit allowed this year. If the credit available on line 1 exceeds the amount

allowed on line 7, the difference may be carried over for a period not to exceed 5 years from the date

the credit was established. You will need to complete a Form 529 for each carryover year.

Computation

1. Loan guaranty fee paid during tax year 2006

00

or unused carryover from tax year _______ . . . . . . . .

2. Net income from the small business or Oklahoma

00

taxable income for banks and credit unions . . . . . . . .

3. Oklahoma adjusted gross income for individuals

00

or Oklahoma taxable income for corporations

and fiduciaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

4. Percentage (Line 2 ÷ Line 3) . . . . . . . . . . . . . . . . . . . .

00

5. Tax per return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

6. Credit limitation (Line 5 X Line 4) . . . . . . . . . . . . . . . .

7. Credit allowed this year - enter the smaller

00

of Line 1 or Line 6 (carry to Form 511CR) . . . . . . . . . .

The Oklahoma Tax Commission is not required to give actual notice to taxpayer of changes in any state tax law.

1

1