Motor Fuel Tax Return Form - City Of Peoria

ADVERTISEMENT

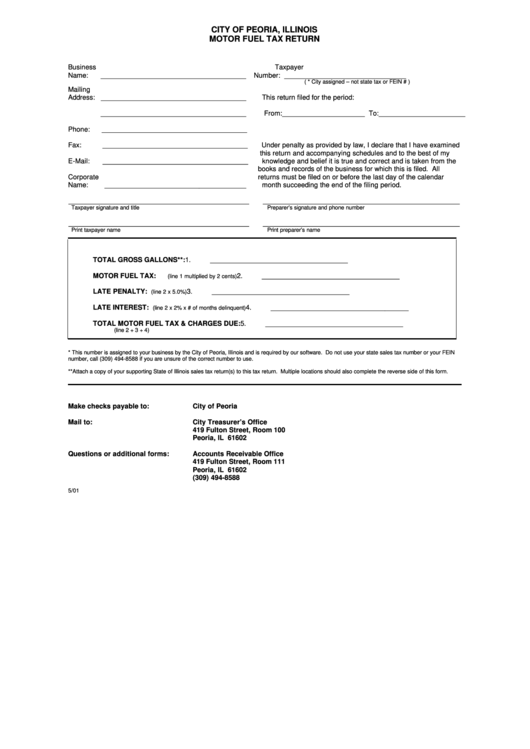

CITY OF PEORIA, ILLINOIS

MOTOR FUEL TAX RETURN

Business

Taxpayer

Name:

_____________________________________

Number: _______________________________

( * City assigned – not state tax or FEIN # )

Mailing

Address: _____________________________________

This return filed for the period:

_____________________________________

From:_____________________ To:______________________

Phone:

_____________________________________

Fax:

_____________________________________

Under penalty as provided by law, I declare that I have examined

this return and accompanying schedules and to the best of my

E-Mail:

_____________________________________

knowledge and belief it is true and correct and is taken from the

books and records of the business for which this is filed. All

Corporate

returns must be filed on or before the last day of the calendar

Name:

____________________________________

month succeeding the end of the filing period.

______________________________________________

__________________________________________________

Taxpayer signature and title

Preparer’s signature and phone number

______________________________________________

__________________________________________________

Print taxpayer name

Print preparer’s name

TOTAL GROSS GALLONS**:

1.

___________________________________

MOTOR FUEL TAX:

2.

___________________________________

(line 1 multiplied by 2 cents)

LATE PENALTY:

3.

___________________________________

(line 2 x 5.0%)

LATE INTEREST:

4.

___________________________________

(line 2 x 2% x # of months delinquent)

TOTAL MOTOR FUEL TAX & CHARGES DUE:

5.

___________________________________

(line 2 + 3 + 4)

* This number is assigned to your business by the City of Peoria, Illinois and is required by our software. Do not use your state sales tax number or your FEIN

number, call (309) 494-8588 if you are unsure of the correct number to use.

**Attach a copy of your supporting State of Illinois sales tax return(s) to this tax return. Multiple locations should also complete the reverse side of this form.

Make checks payable to:

City of Peoria

Mail to:

City Treasurer’s Office

419 Fulton Street, Room 100

Peoria, IL 61602

Questions or additional forms:

Accounts Receivable Office

419 Fulton Street, Room 111

Peoria, IL 61602

(309) 494-8588

5/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2