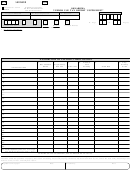

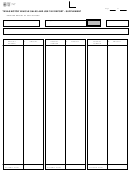

Form 21-3 - Oklahoma Vendors Use Tax Report, Form 21-3-A - Oklahoma Vendor Use Tax Report Supplement Page 2

ADVERTISEMENT

STU

STU0002-07-99-BT

Oklahoma Vendor Use Tax Report Supplement

Form 21-3-A Revised July 2010

D. Account Number

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

M M D D

H. Page

of

Page(s)

F.

-Office Use Only-

F.C.

P.T.

Mailing

Business

G. “X” if Out

“X” for Address Change

E. Mailing Address

of Business

___________________________________________________

Name

___________________________________________________

Address

___________________________________________________

City

State

Zip Code

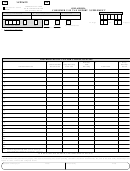

Distribution of Tax for Cities/Counties

City/

I.

J.

K.

L.

M.

N.

O.

Net

City/County

Interest

County

City/County Name

Taxable Sales

Use Tax

Discount

and Penalty

Total Due

Code

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

P.

Total City/County Tax (line 5 through line 24)

(Enter amount on Page 1, line 11)

If More Space is Needed, Use Supplemental Page(s)

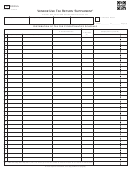

The Oklahoma Tax Commission is not required to give actual notice of changes in any state tax law.

I declare under the penalties of perjury, this return (including any accompanying schedules) has been examined by me, and to the best of my knowledge and

belief is a true, correct, and complete return.

Signature of Taxpayer

Date

Prepared by

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3