Vendor Letter Form

Download a blank fillable Vendor Letter Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Vendor Letter Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Complete and use the buttons at the end to send electronically or to print for mailing.

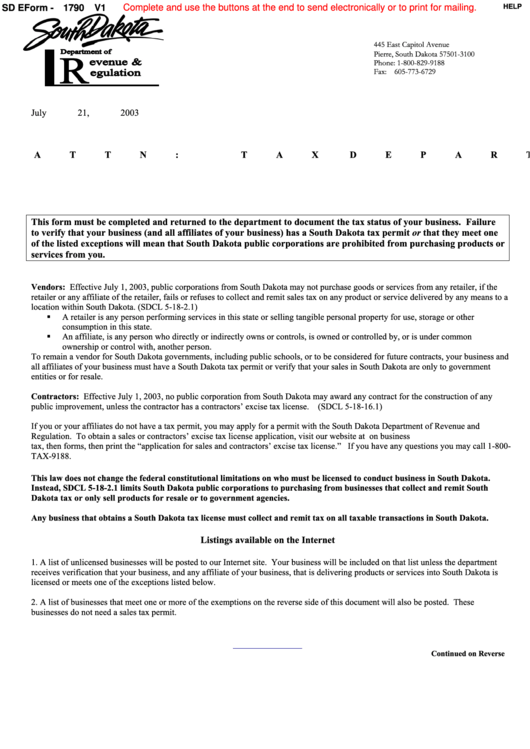

SD EForm - 1790

V1

HELP

445 East Capitol Avenue

Pierre, South Dakota 57501-3100

Phone: 1-800-829-9188

Fax:

605-773-6729

July 21, 2003

ATTN: TAX DEPARTMENT

This form must be completed and returned to the department to document the tax status of your business. Failure

to verify that your business (and all affiliates of your business) has a South Dakota tax permit or that they meet one

of the listed exceptions will mean that South Dakota public corporations are prohibited from purchasing products or

services from you.

Vendors: Effective July 1, 2003, public corporations from South Dakota may not purchase goods or services from any retailer, if the

retailer or any affiliate of the retailer, fails or refuses to collect and remit sales tax on any product or service delivered by any means to a

location within South Dakota. (SDCL 5-18-2.1)

A retailer is any person performing services in this state or selling tangible personal property for use, storage or other

consumption in this state.

An affiliate, is any person who directly or indirectly owns or controls, is owned or controlled by, or is under common

ownership or control with, another person.

To remain a vendor for South Dakota governments, including public schools, or to be considered for future contracts, your business and

all affiliates of your business must have a South Dakota tax permit or verify that your sales in South Dakota are only to government

entities or for resale.

Contractors: Effective July 1, 2003, no public corporation from South Dakota may award any contract for the construction of any

public improvement, unless the contractor has a contractors’ excise tax license. (SDCL 5-18-16.1)

If you or your affiliates do not have a tax permit, you may apply for a permit with the South Dakota Department of Revenue and

Regulation. To obtain a sales or contractors’ excise tax license application, visit our website at Click on business

tax, then forms, then print the “application for sales and contractors’ excise tax license.” If you have any questions you may call 1-800-

TAX-9188.

This law does not change the federal constitutional limitations on who must be licensed to conduct business in South Dakota.

Instead, SDCL 5-18-2.1 limits South Dakota public corporations to purchasing from businesses that collect and remit South

Dakota tax or only sell products for resale or to government agencies.

Any business that obtains a South Dakota tax license must collect and remit tax on all taxable transactions in South Dakota.

Listings available on the Internet

1. A list of unlicensed businesses will be posted to our Internet site. Your business will be included on that list unless the department

receives verification that your business, and any affiliate of your business, that is delivering products or services into South Dakota is

licensed or meets one of the exceptions listed below.

2. A list of businesses that meet one or more of the exemptions on the reverse side of this document will also be posted. These

businesses do not need a sales tax permit.

Continued on Reverse

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2