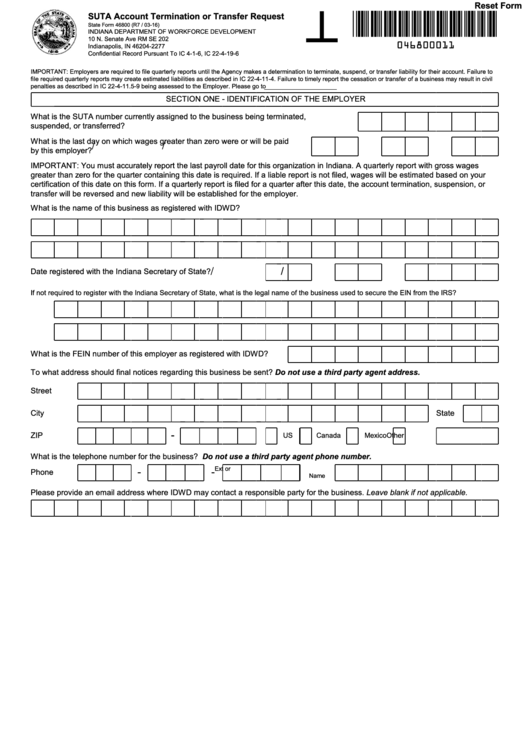

Reset Form

SUTA Account Termination or Transfer Request

*046800011*

State Form 46800 (R7 / 03-16)

INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT

10 N. Senate Ave RM SE 202

046800011

Indianapolis, IN 46204-2277

Confidential Record Pursuant To IC 4-1-6, IC 22-4-19-6

IMPORTANT: Employers are required to file quarterly reports until the Agency makes a determination to terminate, suspend, or transfer liability for their account. Failure to

file required quarterly reports may create estimated liabilities as described in IC 22-4-11-4. Failure to timely report the cessation or transfer of a business may result in civil

penalties as described in IC 22-4-11.5-9 being assessed to the Employer. Please go to for additional information or clarification.

SECTION ONE - IDENTIFICATION OF THE EMPLOYER

What is the SUTA number currently assigned to the business being terminated,

suspended, or transferred?

What is the last day on which wages greater than zero were or will be paid

/

/

by this employer?

IMPORTANT: You must accurately report the last payroll date for this organization in Indiana. A quarterly report with gross wages

greater than zero for the quarter containing this date is required. If a liable report is not filed, wages will be estimated based on your

certification of this date on this form. If a quarterly report is filed for a quarter after this date, the account termination, suspension, or

transfer will be reversed and new liability will be established for the employer.

What is the name of this business as registered with IDWD?

/

Date registered with the Indiana Secretary of State?

/

If not required to register with the Indiana Secretary of State, what is the legal name of the business used to secure the EIN from the IRS?

What is the FEIN number of this employer as registered with IDWD?

To what address should final notices regarding this business be sent? Do not use a third party agent address.

Street

City

State

-

ZIP

US

Canada

Mexico

Other

What is the telephone number for the business? Do not use a third party agent phone number.

Ext or

-

-

Phone

Name

Please provide an email address where IDWD may contact a responsible party for the business. Leave blank if not applicable.

1

1 2

2 3

3