Clear

Print

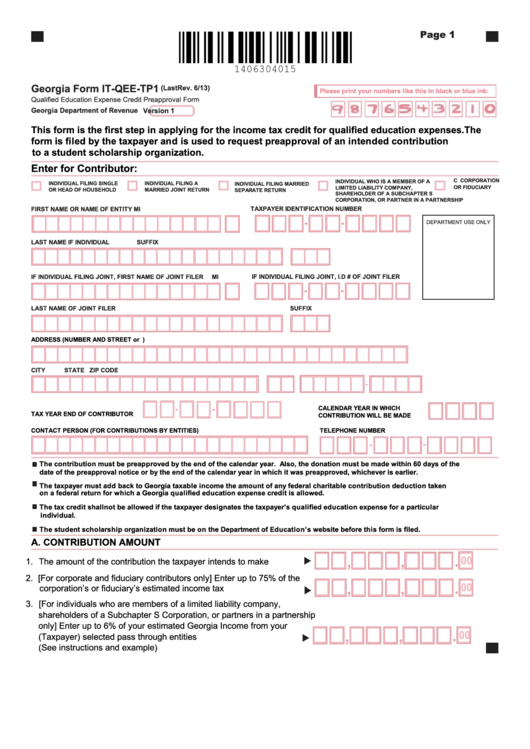

Page 1

Georgia Form IT-QEE-TP1

(Last Rev. 6/13)

Please print your numbers like this in black or blue ink:

Qualified Education Expense Credit Preapproval Form

Georgia Department of Revenue

Version 1

This form is the first step in applying for the income tax credit for qualified education expenses. The

form is filed by the taxpayer and is used to request preapproval of an intended contribution

to a student scholarship organization.

Enter for Contributor:

C CORPORATION

INDIVIDUAL WHO IS A MEMBER OF A

INDIVIDUAL FILING SINGLE

INDIVIDUAL FILING A

INDIVIDUAL FILING MARRIED

LIMITED LIABILITY COMPANY,

OR FIDUCIARY

OR HEAD OF HOUSEHOLD

MARRIED JOINT RETURN

SEPARATE RETURN

SHAREHOLDER OF A SUBCHAPTER S

CORPORATION, OR PARTNER IN A PARTNERSHIP

FIRST NAME OR NAME OF ENTITY

MI

TAXPAYER IDENTIFICATION NUMBER

DEPARTMENT USE ONLY

LAST NAME IF INDIVIDUAL

SUFFIX

IF INDIVIDUAL FILING JOINT, I.D # OF JOINT FILER

IF INDIVIDUAL FILING JOINT, FIRST NAME OF JOINT FILER

MI

LAST NAME OF JOINT FILER

SUFFIX

ADDRESS (NUMBER AND STREET or P.O. BOX)

CITY

STATE

ZIP CODE

CALENDAR YEAR IN WHICH

TAX YEAR END OF CONTRIBUTOR

CONTRIBUTION WILL BE MADE

CONTACT PERSON (FOR CONTRIBUTIONS BY ENTITIES)

TELEPHONE NUMBER

The contribution must be preapproved by the end of the calendar year. Also, the donation must be made within 60 days of the

date of the preapproval notice or by the end of the calendar year in which it was preapproved, whichever is earlier.

The taxpayer must add back to Georgia taxable income the amount of any federal charitable contribution deduction taken

on a federal return for which a Georgia qualified education expense credit is a llowed.

The tax credit shall not be allowed if the taxpayer designates the taxpayer’s qualified education expense for a particular

individual.

The student scholarship organization must be on the Department of Education’s website before this form is filed.

A. CONTRIBUTION AMOUNT

,

,

.

00

1. The amount of the contribution the taxpayer intends to make ...........

2. [For corporate and fiduciary contributors only] Enter up to 75% of the

.

,

,

00

corporation’s or fiduciary’s estimated income tax liability.....................

3. [For individuals who are members of a limited liability company,

shareholders of a Subchapter S Corporation, or partners in a partnership

only] Enter up to 6% of your estimated Georgia Income from your

.

,

,

00

.....................................

(Taxpayer) selected pass through entities

(See instructions and example)

1

1 2

2 3

3 4

4 5

5