Reset Form

Michigan Department of Treasury

3966 (Rev. 11-07)

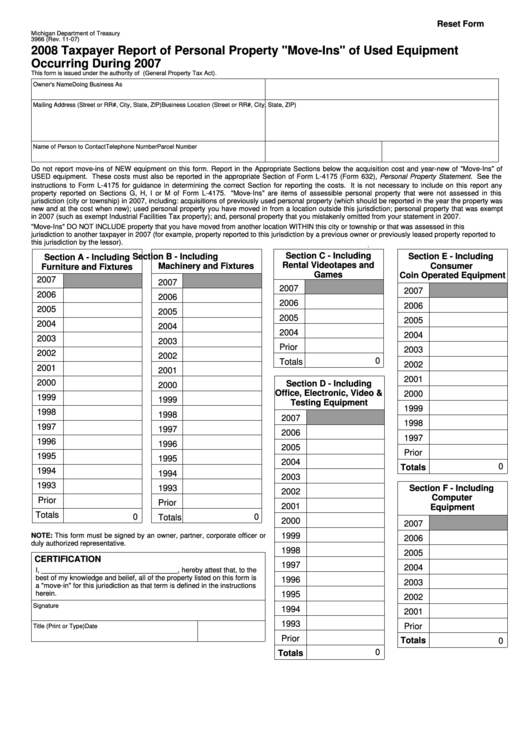

2008 Taxpayer Report of Personal Property "Move-Ins" of Used Equipment

Occurring During 2007

This form is issued under the authority of P.A. 206 of 1893 (General Property Tax Act).

Owner's Name

Doing Business As

Mailing Address (Street or RR#, City, State, ZIP)

Business Location (Street or RR#, City, State, ZIP)

Name of Person to Contact

Telephone Number

Parcel Number

Do not report move-ins of NEW equipment on this form. Report in the Appropriate Sections below the acquisition cost and year-new of "Move-Ins" of

USED equipment. These costs must also be reported in the appropriate Section of Form L-4175 (Form 632), Personal Property Statement. See the

instructions to Form L-4175 for guidance in determining the correct Section for reporting the costs. It is not necessary to include on this report any

property reported on Sections G, H, I or M of Form L-4175. "Move-Ins" are items of assessible personal property that were not assessed in this

jurisdiction (city or township) in 2007, including: acquisitions of previously used personal property (which should be reported in the year the property was

new and at the cost when new); used personal property you have moved in from a location outside this jurisdiction; personal property that was exempt

in 2007 (such as exempt Industrial Facilities Tax property); and, personal property that you mistakenly omitted from your statement in 2007.

"Move-Ins" DO NOT INCLUDE property that you have moved from another location WITHIN this city or township or that was assessed in this

jurisdiction to another taxpayer in 2007 (for example, property reported to this jurisdiction by a previous owner or previously leased property reported to

this jurisdiction by the lessor).

Section C - Including

Section B - Including

Section E - Including

Section A - Including

Rental Videotapes and

Machinery and Fixtures

Consumer

Furniture and Fixtures

Games

Coin Operated Equipment

2007

2007

2007

2007

2006

2006

2006

2006

2005

2005

2005

2005

2004

2004

2004

2004

2003

2003

Prior

2003

2002

2002

0

Totals

2002

2001

2001

2001

2000

Section D - Including

2000

Office, Electronic, Video &

2000

1999

1999

Testing Equipment

1999

1998

1998

2007

1998

1997

1997

2006

1997

1996

1996

2005

Prior

1995

1995

2004

0

Totals

1994

1994

2003

1993

1993

Section F - Including

2002

Computer

Prior

Prior

2001

Equipment

Totals

0

0

Totals

2000

2007

1999

NOTE: This form must be signed by an owner, partner, corporate officer or

2006

duly authorized representative.

1998

2005

CERTIFICATION

1997

2004

I, ___________________________________, hereby attest that, to the

best of my knowledge and belief, all of the property listed on this form is

1996

2003

a "move-in" for this jurisdiction as that term is defined in the instructions

herein.

1995

2002

Signature

1994

2001

1993

Prior

Title (Print or Type)

Date

Prior

Totals

0

0

Totals

1

1