Lodgings Tax Return Form And Information Sheet - City Of Birmingham, Alabama

ADVERTISEMENT

GENERAL INFORMATION FOR PREPARING LODGINGS TAX RETURNS

DUE DATE OF THE TAX.

The tax imposed by Ordinance No. 02−113, the Lodgings Tax Code of the City of Birmingham, shall

twentieth (20th)

be due and payable to the City monthly on or before the

day of the month next succeeding each monthly

period.* The date of the United States postmark stamped on the cover in which this return or payment is mailed shall be

deemed to be the date of delivery, or the date of payment, whether mailed to the Finance Department or to the department's

A return must be filed even if no tax is due.

designated depository.

UNTIMELY FILING.

Any return or payment not received in accordance with the provisions of Section 5(c) of Ordinance

No. 02−113 shall be deemed untimely filed and shall be assessed applicable penalties and interest, as prescribed by

Section 13 of Ordinance No. 02−113. To avoid penalties, returns should be filed by the due date, and any tax amounts

due should be timely paid. Please note that the penalties outlined in Section 13 include, but are not limited to, a penalty

of 10% of the amount of tax due or $50, whichever is greater, which may be assessed for failing to timely file returns.

REQUEST FOR RULING ON DETERMINATION OF TAXATION.

Any taxpayer may request a ruling on the determination of

whether amounts of gross proceeds from the renting or furnishing of any room or rooms, lodgings, or accommodations to

transients in any hotel, motel, inn, or other place in the City are subject to the tax, or are not to be used as a measure of

the taxes due and payable as levied by the Lodgings Tax Code. Such requests shall be made in writing to the Finance

Department, and shall contain all pertinent facts and documentation of any written determinations or revenue rulings issued

by the State of Alabama Department of Revenue relating to the item(s) in question.

THE LODGINGS TAX RATE.

Pursuant to Ordinance No. 02−113, effective December 1, 2002, a privilege or license tax is

levied and imposed on every person, firm, or corporation engaged in the business of renting or furnishing any room or rooms,

lodgings, or accommodations to transients in any hotel, motel, inn, tourist camp, tourist cabin, or any other place in which rooms,

lodgings, or accommodations are regularly furnished to transients for consideration in an amount to be determined by the

three percent (3%)

of the charge of such room, rooms, lodgings, or accommodations including the

application of the rate of

charge for use or rental of tangible personal property and services furnished in such rooms. The tax shall not apply to rooms,

lodging or accommodations applied for a period of one hundred eighty (180) continuous days. All gross proceeds from lodgings

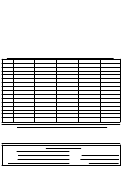

shall be entered under Column A on the appropriate line. All deductions of such items shall be entered under Column B and

detailed in the "STANDARD DEDUCTION SUMMARY TABLE" on the reverse side of the return form.

NUMBER OF ROOMS OCCUPIED DURING THE MONTH.

Ordinance No. 02−113 provides that each monthly Lodgings Tax

return shall show the "number of rooming nights accrued during the reporting period". The number of rooms so accrued shall

be entered in the appropriate space on the return form.

MISCELLANEOUS.

Any person who sells out or quits business is required to file a final return within thirty (30) days after

the date of selling out or quitting business. The new owner or successor shall be required to hold out sufficient of the

purchase money to cover the amount of any Lodgings Tax that may be due by the former owner. If the new owner or

successor shall fail to withhold purchase money as required by Section 16 of Ordinance 02−113, and the taxes remain

due and unpaid after said thirty (30) day period, he shall be personally liable for the payment of the amount of taxes

required to be remitted by the former owner, and any interest and penalties accrued and unpaid by any former owner.

If in such case the department deems it necessary in order to collect the taxes due, it may make a jeopardy assessment

as provided in Title 40, Chapter 29 of the Code of Alabama 1975.

MAKE CHECKS PAYABLE TO: City of Birmingham

MAIL TO:

CITY OF BIRMINGHAM

REVENUE DIVISION

P.O. BOX 830638

BIRMINGHAM, ALABAMA 35283−0638

*Note: (1)

If the total amount of gross proceeds for which a person is liable does not exceed $5,000 per month during

the preceding calendar year, a quarterly return may be filed on or before the 20th day of the month next

succeeding the end of the quarter for which the tax is due. This election must be made in writing and filed

with the department no later than February 20th of each year. If such election is not timely made, returns shall

be due monthly.

(2)

If the total amount of taxable gross proceeds for which a person is liable does not exceed $250 during the

preceding calendar year, the taxpayer may elect to file a yearly return in lieu of monthly or quarterly returns. In

order to file yearly, the election shall be made in writing and shall be filed with the department. Such yearly

return shall be filed no later than January 20th of each year. If such election is not timely made, and in

accordance with the provisions of Ordinance No. 02−113, returns shall be due monthly.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3