Form Gj410 - Annual Use Tax Return - City Of Grand Junction - 2001

ADVERTISEMENT

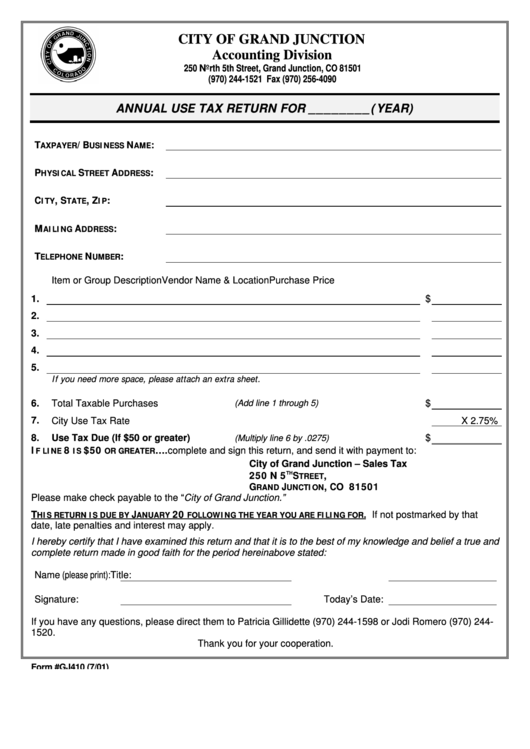

CITY OF GRAND JUNCTION

Accounting Division

250 North 5th Street, Grand Junction, CO 81501

(970) 244-1521 Fax (970) 256-4090

ANNUAL USE TAX RETURN FOR ________(YEAR)

T

/B

N

:

AXPAYER

USINESS

AME

P

S

A

:

HYSICAL

TREET

DDRESS

C

, S

, Z

:

ITY

TATE

IP

M

A

:

AILING

DDRESS

T

N

:

ELEPHONE

UMBER

Item or Group Description

Vendor Name & Location

Purchase Price

1.

$

2.

3.

4.

5.

If you need more space, please attach an extra sheet.

6.

Total Taxable Purchases

$

(Add line 1 through 5)

7.

City Use Tax Rate

X 2.75%

8.

Use Tax Due (If $50 or greater)

(Multiply line 6 by .0275)

$

I

8

$50

….complete and sign this return, and send it with payment to:

F LINE

IS

OR GREATER

City of Grand Junction – Sales Tax

250 N 5

S

,

TH

TREET

G

J

, CO 81501

RAND

UNCTION

Please make check payable to the “City of Grand Junction.”

T

J

20

. If not postmarked by that

HIS RETURN IS DUE BY

ANUARY

FOLLOWING THE YEAR YOU ARE FILING FOR

date, late penalties and interest may apply.

I hereby certify that I have examined this return and that it is to the best of my knowledge and belief a true and

complete return made in good faith for the period hereinabove stated:

Name (please print):

Title:

Signature:

Today’s Date:

If you have any questions, please direct them to Patricia Gillidette (970) 244-1598 or Jodi Romero (970) 244-

1520.

Thank you for your cooperation.

Form #GJ410 (7/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1