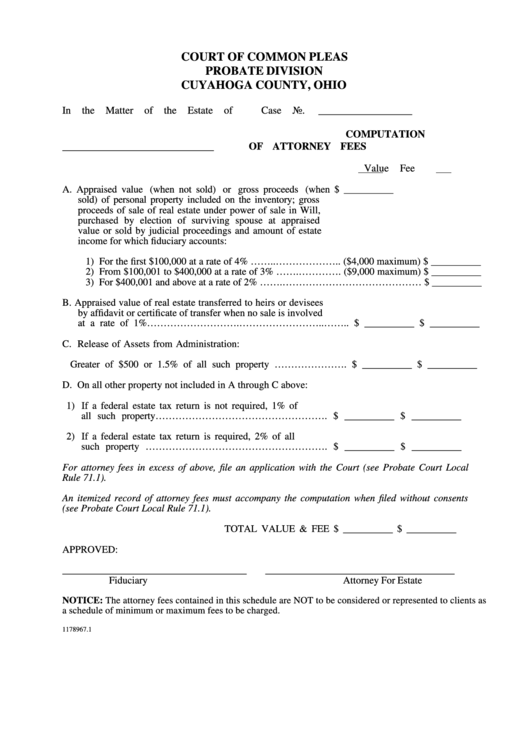

COURT OF COMMON PLEAS

PROBATE DIVISION

CUYAHOGA COUNTY, OHIO

In the Matter of the Estate of

Case No. __________________

COMPUTATION

_____________________________

OF ATTORNEY FEES

Value

Fee

A. Appraised value (when not sold) or gross proceeds (when

$ __________

sold) of personal property included on the inventory; gross

proceeds of sale of real estate under power of sale in Will,

purchased by election of surviving spouse at appraised

value or sold by judicial proceedings and amount of estate

income for which fiduciary accounts:

1) For the first $100,000 at a rate of 4% ……..……………….. ($4,000 maximum) $ __________

2) From $100,001 to $400,000 at a rate of 3% …….…………. ($9,000 maximum) $ __________

3) For $400,001 and above at a rate of 2% …….…………………………………… $ __________

B. Appraised value of real estate transferred to heirs or devisees

by affidavit or certificate of transfer when no sale is involved

at a rate of 1%……………………….……………………..…….. $ __________

$ __________

C. Release of Assets from Administration:

Greater of $500 or 1.5% of all such property …………………. $ __________

$ __________

D. On all other property not included in A through C above:

1) If a federal estate tax return is not required, 1% of

all such property……………………………………………. $ __________

$ __________

2) If a federal estate tax return is required, 2% of all

such property ………………………………………………. $ __________

$ __________

For attorney fees in excess of above, file an application with the Court (see Probate Court Local

Rule 71.1).

An itemized record of attorney fees must accompany the computation when filed without consents

(see Probate Court Local Rule 71.1).

TOTAL VALUE & FEE

$ __________

$ __________

APPROVED:

_____________________________________

______________________________________

Fiduciary

Attorney For Estate

NOTICE: The attorney fees contained in this schedule are NOT to be considered or represented to clients as

a schedule of minimum or maximum fees to be charged.

1178967.1

1

1