Print and Reset Form

Reset Form

YEAR

CALIFORNIA FORM

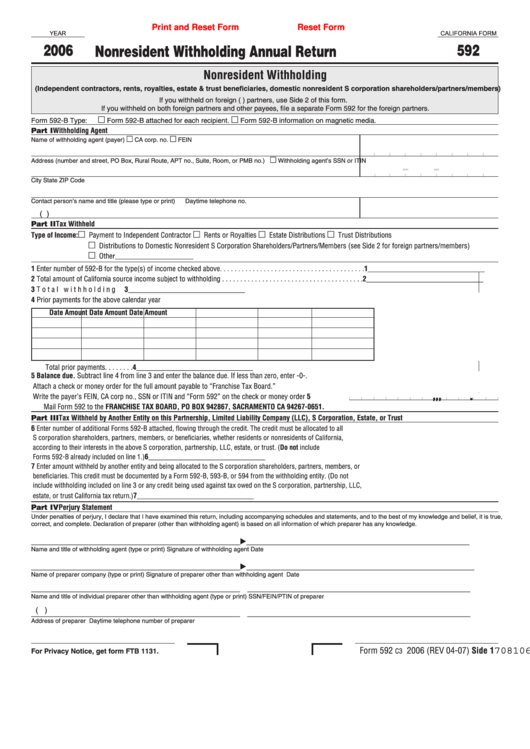

2006

592

Nonresident Withholding Annual Return

Nonresident Withholding

(Independent contractors, rents, royalties, estate & trust beneficiaries, domestic nonresident S corporation shareholders/partners/members)

If you withheld on foreign (non-U.S.) partners, use Side 2 of this form.

If you withheld on both foreign partners and other payees, file a separate Form 592 for the foreign partners.

Form 592-B Type:

Form 592-B attached for each recipient.

Form 592-B information on magnetic media.

Part I Withholding Agent

Name of withholding agent (payer)

CA corp. no.

FEIN

Address (number and street, PO Box, Rural Route, APT no., Suite, Room, or PMB no.)

Withholding agent’s SSN or ITIN

City

State

ZIP Code

Contact person’s name and title (please type or print)

Daytime telephone no.

(

)

Part II Tax Withheld

Type of Income:

Payment to Independent Contractor

Rents or Royalties

Estate Distributions

Trust Distributions

Distributions to Domestic Nonresident S Corporation Shareholders/Partners/Members (see Side 2 for foreign partners/members)

Other

_______________________

�

Enter number of 592-B for the type(s) of income checked above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �________________________________

2

Total amount of California source income subject to withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2________________________________

3

Total withholding due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3________________________________

4

Prior payments for the above calendar year

Date

Amount

Date

Amount

Date

Amount

Total prior payments . . . . . . . . 4________________________________

5

Balance due. Subtract line 4 from line 3 and enter the balance due . If less than zero, enter -0- .

Attach a check or money order for the full amount payable to “Franchise Tax Board .”

.

5

,

,

,

Write the payer’s FEIN, CA corp no ., SSN or ITIN and “Form 592” on the check or money order

Mail Form 592 to the FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-065�.

Part III Tax Withheld by Another Entity on this Partnership, Limited Liability Company (LLC), S Corporation, Estate, or Trust

6

Enter number of additional Forms 592-B attached, flowing through the credit . The credit must be allocated to all

S corporation shareholders, partners, members, or beneficiaries, whether residents or nonresidents of California,

according to their interests in the above S corporation, partnership, LLC, estate, or trust . (Do not include

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6________________________________

Forms 592-B already included on line 1 .)

7

Enter amount withheld by another entity and being allocated to the S corporation shareholders, partners, members, or

beneficiaries . This credit must be documented by a Form 592-B, 593-B, or 594 from the withholding entity . (Do not

include withholding included on line 3 or any credit being used against tax owed on the S corporation, partnership, LLC,

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7________________________________

estate, or trust California tax return .)

Part IV Perjury Statement

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

correct, and complete. Declaration of preparer (other than withholding agent) is based on all information of which preparer has any knowledge.

____________________________________________

_______________________________________________

Name and title of withholding agent (type or print)

Signature of withholding agent

Date

____________________________________________

________________________________________________

Name of preparer company (type or print)

Signature of preparer other than withholding agent

Date

____________________________________________

_______________________________________________

Name and title of individual preparer other than withholding agent (type or print)

SSN/FEIN/PTIN of preparer

(

)

____________________________________________

_______________________________________________

Address of preparer

Daytime telephone number of preparer

Form 592

2006 (REV 04-07) Side �

7081063

For Privacy Notice, get form FTB 1131.

C3

1

1 2

2