Form Eta-9061 - Individual Characteristics Form Work Opportunity Tax Credit And Welfare-To-Work Tax Credit 1998

ADVERTISEMENT

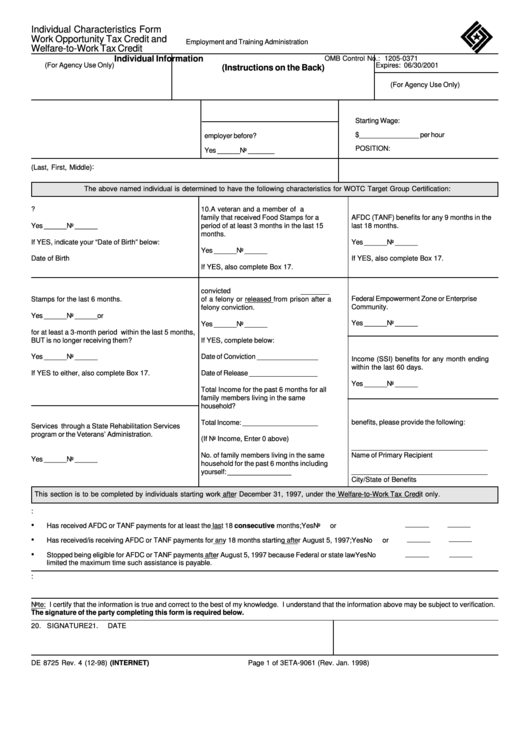

Individual Characteristics Form

U.S. Department of Labor

Work Opportunity Tax Credit and

Employment and Training Administration

Welfare-to-Work Tax Credit

U.S. Employment Service

1.

CONTROL NO.

Individual Information

OMB Control No.: 1205-0371

(For Agency Use Only)

Expires: 06/30/2001

(Instructions on the Back)

2.

DATE RECEIVED

(For Agency Use Only)

4.

EMPLOYER ID NUMBER

3.

EMPLOYER NAME/ADDRESS

5.

EMPLOYMENT START DATE

Starting Wage:

6. Have you worked for the above

$________________ per hour

employer before?

POSITION:

Yes ______

No _______

8. SOCIAL SECURITY NUMBER:

7. NAME OF INDIVIDUAL (Last, First, Middle)

The above named individual is determined to have the following characteristics for WOTC Target Group Certification:

9.

Age between 16 - 25?

10. A veteran and a member of a

11. Is a member of a family that received

family that received Food Stamps for a

AFDC (TANF) benefits for any 9 months in the

Yes ______

No ______

period of at least 3 months in the last 15

last 18 months.

months.

If YES, indicate your “Date of Birth” below:

Yes ______

No ______

Yes ______

No ______

Date of Birth

If YES, also complete Box 17.

If YES, also complete Box 17.

14.

Lives and plans to continue living in a

12. Is a member of a family that received Food

13. In the past year has been convicted

Federal Empowerment Zone or Enterprise

Stamps for the last 6 months.

of a felony or released from prison after a

Community.

felony conviction.

Yes ______

No ______

or

Yes ______

No ______

Yes ______

No ______

for at least a 3-month period within the last 5 months,

BUT is no longer receiving them?

If YES, complete below:

16.

Received Supplemental Security

Yes ______

No ______

Date of Conviction ________________

Income (SSI) benefits for any month ending

within the last 60 days.

If YES to either, also complete Box 17.

Date of Release __________________

Yes ______

No ______

Total Income for the past 6 months for all

family members living in the same

household?

17. If individual is not a primary recipient of

15. Is receiving or has received Rehabilitation

Total Income: ____________________

benefits, please provide the following:

Services through a State Rehabilitation Services

program or the Veterans’ Administration.

(If No Income, Enter 0 above)

_____________________________________

No. of family members living in the same

Name of Primary Recipient

Yes ______

No ______

household for the past 6 months including

_____________________________________

yourself: _________________

City/State of Benefits

This section is to be completed by individuals starting work after December 31, 1997, under the Welfare-to-Work Tax Credit only.

18. Is a member of a family that:

•

Has received AFDC or TANF payments for at least the last 18 consecutive months;

Yes

No

or

•

Has received/is receiving AFDC or TANF payments for any 18 months starting after August 5, 1997;

Yes

No

or

•

Stopped being eligible for AFDC or TANF payments after August 5, 1997 because Federal or state law

Yes

No

limited the maximum time such assistance is payable.

19. SOURCES USED TO DOCUMENT ELIGIBILITY:

Note: I certify that the information is true and correct to the best of my knowledge. I understand that the information above may be subject to verification.

The signature of the party completing this form is required below.

20. SIGNATURE

21.

DATE

DE 8725 Rev. 4 (12-98) (INTERNET)

Page 1 of 3

ETA-9061 (Rev. Jan. 1998)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1