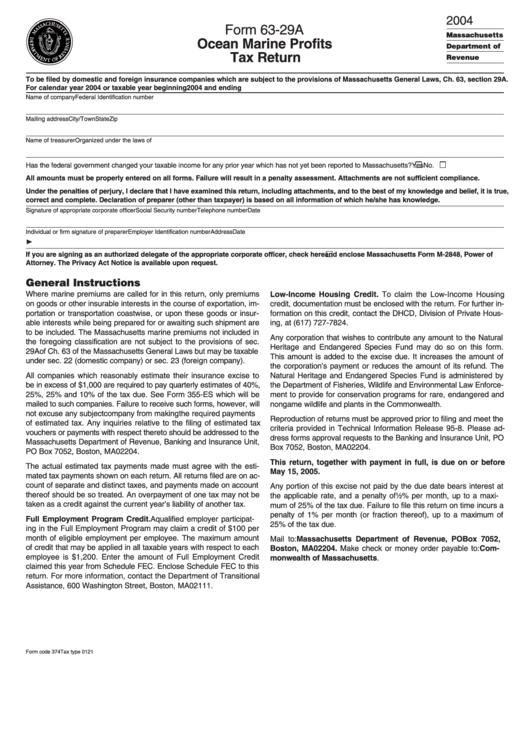

Form 63-29a - Ocean Marine Profits Tax Return - 2004

ADVERTISEMENT

2004

Form 63-29A

Massachusetts

Ocean Marine Profits

Department of

Tax Return

Revenue

To be filed by domestic and foreign insurance companies which are subject to the provisions of Massachusetts General Laws, Ch. 63, section 29A.

For calendar year 2004 or taxable year beginning

2004 and ending

Name of company

Federal Identification number

Mailing address

City/Town

State

Zip

Name of treasurer

Organized under the laws of

Has the federal government changed your taxable income for any prior year which has not yet been reported to Massachusetts?

Yes

No.

All amounts must be properly entered on all forms. Failure will result in a penalty assessment. Attachments are not sufficient compliance.

Under the penalties of perjury, I declare that I have examined this return, including attachments, and to the best of my knowledge and belief, it is true,

correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has knowledge.

Signature of appropriate corporate officer

Social Security number

Telephone number

Date

Individual or firm signature of preparer

Employer Identification number

Address

Date

❿

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and enclose Massachusetts Form M-2848, Power of

Attorney. The Privacy Act Notice is available upon request.

General Instructions

Where marine premiums are called for in this return, only premiums

Low-Income Housing Credit. To claim the Low-Income Housing

on goods or other insurable interests in the course of exportation, im-

credit, documentation must be enclosed with the return. For further in-

portation or transportation coastwise, or upon these goods or insur-

formation on this credit, contact the DHCD, Division of Private Hous-

able interests while being prepared for or awaiting such shipment are

ing, at (617) 727-7824.

to be included. The Massachusetts marine premiums not included in

Any corporation that wishes to contribute any amount to the Natural

the foregoing classification are not subject to the provisions of sec.

Heritage and Endangered Species Fund may do so on this form.

29A of Ch. 63 of the Massachusetts General Laws but may be taxable

This amount is added to the excise due. It increases the amount of

under sec. 22 (domestic company) or sec. 23 (foreign company).

the corporation’s payment or reduces the amount of its refund. The

All companies which reasonably estimate their insurance excise to

Natural Heritage and Endangered Species Fund is administered by

be in excess of $1,000 are required to pay quarterly estimates of 40%,

the Department of Fisheries, Wildlife and Environmental Law Enforce-

25%, 25% and 10% of the tax due. See Form 355-ES which will be

ment to provide for conservation programs for rare, endangered and

mailed to such companies. Failure to receive such forms, however, will

nongame wildlife and plants in the Commonwealth.

not excuse any subject company from making the required payments

Reproduction of returns must be approved prior to filing and meet the

of estimated tax. Any inquiries relative to the filing of estimated tax

criteria provided in Technical Information Release 95-8. Please ad-

vouchers or payments with respect thereto should be addressed to the

dress forms approval requests to the Banking and Insurance Unit, PO

Massachusetts Department of Revenue, Banking and Insurance Unit,

Box 7052, Boston, MA 02204.

PO Box 7052, Boston, MA 02204.

This return, together with payment in full, is due on or before

The actual estimated tax payments made must agree with the esti-

May 15, 2005.

mated tax payments shown on each return. All returns filed are on ac-

count of separate and distinct taxes, and payments made on account

Any portion of this excise not paid by the due date bears interest at

the applicable rate, and a penalty of ¹ ₂% per month, up to a maxi-

thereof should be so treated. An overpayment of one tax may not be

taken as a credit against the current year’s liability of another tax.

mum of 25% of the tax due. Failure to file this return on time incurs a

penalty of 1% per month (or fraction thereof), up to a maximum of

Full Employment Program Credit. A qualified employer participat-

25% of the tax due.

ing in the Full Employment Program may claim a credit of $100 per

month of eligible employment per employee. The maximum amount

Mail to: Massachusetts Department of Revenue, PO Box 7052,

of credit that may be applied in all taxable years with respect to each

Boston, MA 02204. Make check or money order payable to: Com-

employee is $1,200. Enter the amount of Full Employment Credit

monwealth of Massachusetts.

claimed this year from Schedule FEC. Enclose Schedule FEC to this

return. For more information, contact the Department of Transitional

Assistance, 600 Washington Street, Boston, MA 02111.

Form code 374 Tax type 0121

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5