Authorization Form For Direct Payment

ADVERTISEMENT

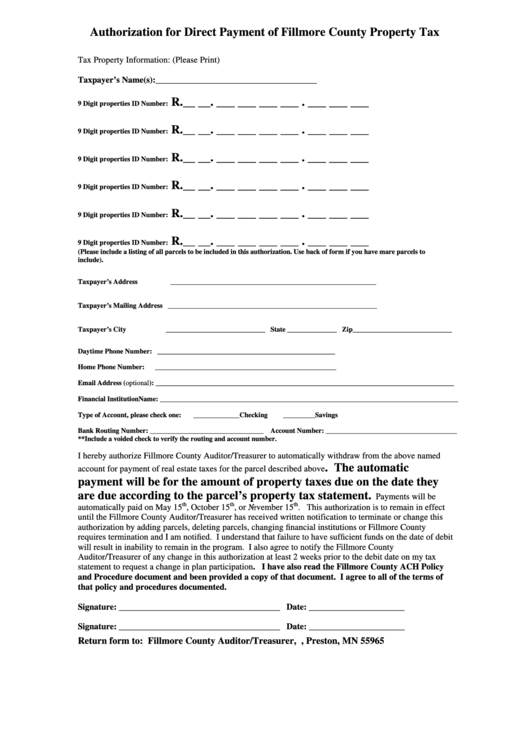

Authorization for Direct Payment of Fillmore County Property Tax

Tax Property Information: (Please Print)

Taxpayer’s Name(s):_____________________________________

R.__ __. ___ ___ ___ ___ . ___ ___ ___

9 Digit properties ID Number:

R.__ __. ___ ___ ___ ___ . ___ ___ ___

9 Digit properties ID Number:

R.__ __. ___ ___ ___ ___ . ___ ___ ___

9 Digit properties ID Number:

R.__ __. ___ ___ ___ ___ . ___ ___ ___

9 Digit properties ID Number:

R.__ __. ___ ___ ___ ___ . ___ ___ ___

9 Digit properties ID Number:

R.__ __. ___ ___ ___ ___ . ___ ___ ___

9 Digit properties ID Number:

(Please include a listing of all parcels to be included in this authorization. Use back of form if you have mare parcels to

include).

Taxpayer’s Address

__________________________________________________________

Taxpayer’s Mailing Address ___________________________________________________________

Taxpayer’s City

____________________________ State ______________ Zip____________________________

Daytime Phone Number: __________________________________________________

Home Phone Number:

___________________________________________________

Email Address (optional): ____________________________________________________________________________________

Financial InstitutionName: ____________________________________________________________________________________

Type of Account, please check one:

_____________Checking

_________Savings

Bank Routing Number: ________________________________ Account Number: _____________________________________

**Include a voided check to verify the routing and account number.

I hereby authorize Fillmore County Auditor/Treasurer to automatically withdraw from the above named

. The automatic

account for payment of real estate taxes for the parcel described above

payment will be for the amount of property taxes due on the date they

are due according to the parcel’s property tax statement.

Payments will be

th

th

th

automatically paid on May 15

, October 15

, or November 15

. This authorization is to remain in effect

until the Fillmore County Auditor/Treasurer has received written notification to terminate or change this

authorization by adding parcels, deleting parcels, changing financial institutions or Fillmore County

requires termination and I am notified. I understand that failure to have sufficient funds on the date of debit

will result in inability to remain in the program. I also agree to notify the Fillmore County

Auditor/Treasurer of any change in this authorization at least 2 weeks prior to the debit date on my tax

statement to request a change in plan participation. I have also read the Fillmore County ACH Policy

and Procedure document and been provided a copy of that document. I agree to all of the terms of

that policy and procedures documented.

Signature: _____________________________________ Date: ______________________

Signature: _____________________________________ Date: ______________________

Return form to: Fillmore County Auditor/Treasurer, P.O. Box 627, Preston, MN 55965

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1