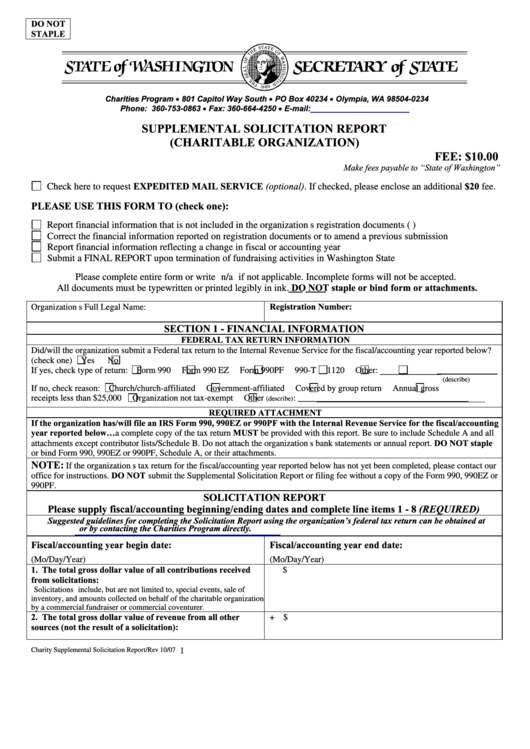

Supplemental Solicitation Report - Washington Secretary Of State

ADVERTISEMENT

DO NOT

STAPLE

Charities Program · 801 Capitol Way South · PO Box 40234 · Olympia, WA 98504-0234

Phone: 360-753-0863 · Fax: 360-664-4250 · E-mail:

charities@secstate.wa.gov

SUPPLEMENTAL SOLICITATION REPORT

(CHARITABLE ORGANIZATION)

FEE: $10.00

Make fees payable to State of Washington

Check here to request EXPEDITED MAIL SERVICE (optional). If checked, please enclose an additional $20 fee.

PLEASE USE THIS FORM TO (check one):

Report financial information that is not included in the organization s registration documents (e.g. multiple years)

Correct the financial information reported on registration documents or to amend a previous submission

Report financial information reflecting a change in fiscal or accounting year

Submit a FINAL REPORT upon termination of fundraising activities in Washington State

Please complete entire form or write n/a if not applicable. Incomplete forms will not be accepted.

All documents must be typewritten or printed legibly in ink. DO NOT staple or bind form or attachments.

Registration Number:

Organization s Full Legal Name:

SECTION 1 - FINANCIAL INFORMATION

FEDERAL TAX RETURN INFORMATION

Did/will the organization submit a Federal tax return to the Internal Revenue Service for the fiscal/accounting year reported below?

(check one)

Yes

No

Other: ______________

If yes, check type of return:

Form 990

Form 990 EZ

Form 990PF

990-T

1120

(describe)

If no, check reason:

Church/church-affiliated

Government-affiliated

Covered by group return

Annual gross

receipts less than $25,000

Organization not tax-exempt

Other

: _______________________________________

(describe)

REQUIRED ATTACHMENT

If the organization has/will file an IRS Form 990, 990EZ or 990PF with the Internal Revenue Service for the fiscal/accounting

year reported below a complete copy of the tax return MUST be provided with this report. Be sure to include Schedule A and all

attachments except contributor lists/Schedule B. Do not attach the organization s bank statements or annual report. DO NOT staple

or bind Form 990, 990EZ or 990PF, Schedule A, or their attachments.

NOTE:

If the organization s tax return for the fiscal/accounting year reported below has not yet been completed, please contact our

office for instructions. DO NOT submit the Supplemental Solicitation Report or filing fee without a copy of the Form 990, 990EZ or

990PF.

SOLICITATION REPORT

Please supply fiscal/accounting beginning/ending dates and complete line items 1 - 8 (REQUIRED)

Suggested guidelines for completing the Solicitation Report using the organization s federal tax return can be obtained at

or by contacting the Charities Program directly.

Fiscal/accounting year begin date:

Fiscal/accounting year end date:

(Mo/Day/Year)

(Mo/Day/Year)

1. The total gross dollar value of all contributions received

$

from solicitations:

Solicitations include, but are not limited to, special events, sale of

inventory, and amounts collected on behalf of the charitable organization

by a commercial fundraiser or commercial coventurer.

2. The total gross dollar value of revenue from all other

+ $

sources (not the result of a solicitation):

Charity Supplemental Solicitation Report/Rev 10/07

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2