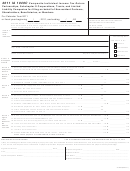

Virginia Resident Form 760 - Individual Income Tax Return - 2011 Page 2

ADVERTISEMENT

Page 2

Your ssn

*VA0760211000*

Form 760

-

-

2011

Year

00

,

,

.

15. Amount of Tax from Tax Table or Tax Rate Schedule (round to whole dollars) ...........................15

16. Spouse Tax Adjustment. For Filing Status 2 only. Enter VAGI in whole dollars below. See instructions.

16a - Enter Your VAGI below

16b - Enter Spouse’s VAGI below

00

.

loss

loss

16

.00

,

,

,

,

.00

00

,

,

.

17. Net Amount of Tax - Subtract Line 16 from Line 15 ...............................................................17

18. Virginia tax withheld for 2011.

00

.

,

,

18a. Your Virginia withholding ...................................................................................................18a

00

.

,

,

18b. Spouse’s Virginia withholding (filing status 2 only) ...........................................................18b

00

,

,

,

,

.

19. Estimated Tax Paid for tax year 2011 (from Form 760ES) ...........................................................19

(include overpayment credited from tax year 2010)

00

,

,

.

20. Extension Payments (from Form 760IP) ......................................................................................20

00

,

.

21. Tax Credit for Low Income Individuals or Earned Income Credit from attached Sch. ADJ, Line 17 .....21

00

,

,

.

22. Credit for Tax Paid to Another State from attached Sch. OSC, Line 21 ......................................22

(You must attach Sch. OSC and a copy of all other state returns)

00

,

,

.

23. Other Credits from attached Schedule CR ................................................................................23

(If claiming Political Contribution Credit only - fill in oval - see instructions)

00

,

,

.

24. Add Lines 18a, 18b and 19 through 23 ....................................................................................24

00

,

,

.

25. If Line 24 is less than Line 17, subtract Line 24 from Line 17. This is the Tax You Owe ............25

Skip to Line 28

00

,

,

.

26. If Line 17 is less than Line 24, subtract Line 17 from Line 24. This is Your Tax Overpayment ...26

00

,

,

.

27. Amount of overpayment you want credited to next year’s estimated tax ....................................27

00

,

,

.

28. Adjustments and Voluntary Contributions from attached Schedule ADJ, Line 24 .......................28

(You must attach Schedule ADJ)

00

,

,

.

29. Add Lines 27 and 28.....................................................................................................................29

30. If you owe tax on Line 25, add Lines 25 and 29. OR

00

If Line 26 is less than Line 29, subtract Line 26 from Line 29. AMOUNT YOU OWE ................30

,

,

.

CREDIT

-

fill in oval if paying by credit or debit card

see instructions

CARD

00

,

,

.

31. If Line 26 is greater than Line 29, subtract Line 29 from Line 26. YOUR REFUND ....................31

Checking

Savings

Account Type

Direct Deposit information

For domestic direct deposit

refunds only. See instructions.

Your bank routing transit number

Your bank account number

Qualifying farmer, fisherman or merchant seaman

Federal Schedule C filed with your federal return

Fill in all

ovals that

Earned Income Credit claimed on your federal return.

,

Overseas on due date

apply:

Amount claimed:

Primary Taxpayer Deceased

spouse Deceased

i (We), the undersigned, declare under penalty of law that i (we) have examined this return and to the best of my (our) knowledge, it is a true, correct and complete return.

Your Signature

Date

Spouse’s Signature

Date

Your business phone number

Home phone number

Spouse’s business phone number

-

-

-

-

-

-

Filing

Preparer’s PTIN

Preparer’s Signature

Preparer’s Name, Address & Phone Number (please print)

Election

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2