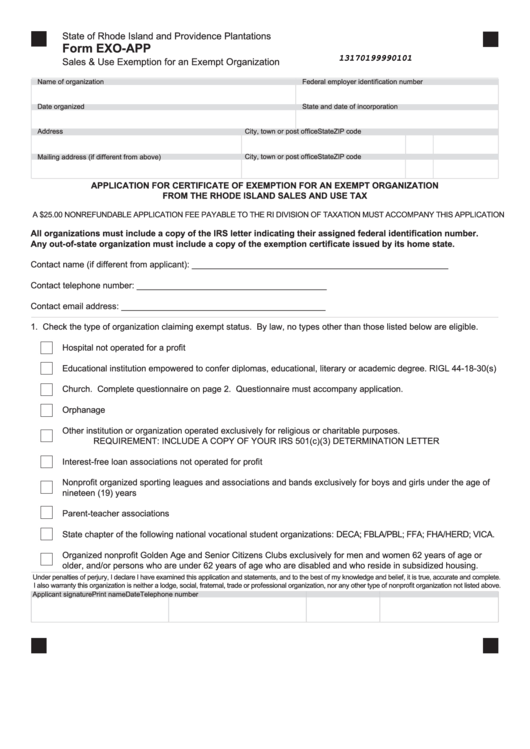

State of Rhode Island and Providence Plantations

Form EXO-APP

13170199990101

Sales & Use Exemption for an Exempt Organization

Name of organization

Federal employer identification number

Date organized

State and date of incorporation

Address

City, town or post office

State

ZIP code

Mailing address (if different from above)

City, town or post office

State

ZIP code

APPLICATION FOR CERTIFICATE OF EXEMPTION FOR AN EXEMPT ORGANIZATION

FROM THE RHODE ISLAND SALES AND USE TAX

A $25.00 NONREFUNDABLE APPLICATION FEE PAYABLE TO THE RI DIVISION OF TAXATION MUST ACCOMPANY THIS APPLICATION

All organizations must include a copy of the IRS letter indicating their assigned federal identification number.

Any out-of-state organization must include a copy of the exemption certificate issued by its home state.

Contact name (if different from applicant): ______________________________________________________

Contact telephone number: ________________________________________

Contact email address: ___________________________________________

1. Check the type of organization claiming exempt status. By law, no types other than those listed below are eligible.

Hospital not operated for a profit

Educational institution empowered to confer diplomas, educational, literary or academic degree. RIGL 44-18-30(s)

Church. Complete questionnaire on page 2. Questionnaire must accompany application.

Orphanage

Other institution or organization operated exclusively for religious or charitable purposes.

REQUIREMENT: INCLUDE A COPY OF YOUR IRS 501(c)(3) DETERMINATION LETTER

Interest-free loan associations not operated for profit

Nonprofit organized sporting leagues and associations and bands exclusively for boys and girls under the age of

nineteen (19) years

Parent-teacher associations

State chapter of the following national vocational student organizations: DECA; FBLA/PBL; FFA; FHA/HERD; VICA.

Organized nonprofit Golden Age and Senior Citizens Clubs exclusively for men and women 62 years of age or

older, and/or persons who are under 62 years of age who are disabled and who reside in subsidized housing.

Under penalties of perjury, I declare I have examined this application and statements, and to the best of my knowledge and belief, it is true, accurate and complete.

I also warranty this organization is neither a lodge, social, fraternal, trade or professional organization, nor any other type of nonprofit organization not listed above.

Applicant signature

Print name

Date

Telephone number

1

1 2

2