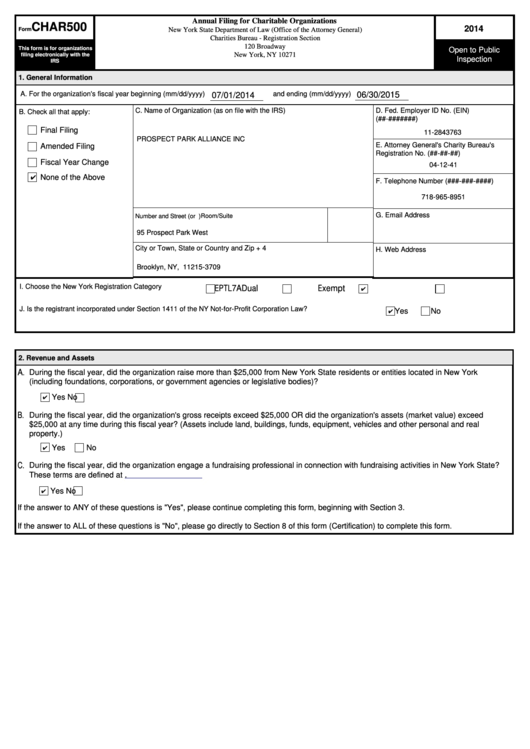

Annual Filing for Charitable Organizations

CHAR500

2014

Form

New York State Department of Law (Office of the Attorney General)

Charities Bureau - Registration Section

120 Broadway

This form is for organizations

Open to Public

New York, NY 10271

filing electronically with the

Inspection

IRS

1. General Information

A. For the organization's fiscal year beginning (mm/dd/yyyy)

and ending (mm/dd/yyyy)

07/01/2014

06/30/2015

C. Name of Organization (as on file with the IRS)

D. Fed. Employer ID No. (EIN)

B. Check all that apply:

(##-#######)

Final Filing

11-2843763

PROSPECT PARK ALLIANCE INC

E. Attorney General's Charity Bureau's

Amended Filing

Registration No. (##-##-##)

Fiscal Year Change

04-12-41

None of the Above

F. Telephone Number (###-###-####)

718-965-8951

G. Email Address

Room/Suite

Number and Street (or P.O. Box if mail not delivered to street address)

95 Prospect Park West

City or Town, State or Country and Zip + 4

H. Web Address

Brooklyn, NY, 11215-3709

EPTL

7A

Dual

Exempt

I. Choose the New York Registration Category

J. Is the registrant incorporated under Section 1411 of the NY Not-for-Profit Corporation Law?

Yes

No

2. Revenue and Assets

A.

During the fiscal year, did the organization raise more than $25,000 from New York State residents or entities located in New York

(including foundations, corporations, or government agencies or legislative bodies)?

Yes

No

B.

During the fiscal year, did the organization's gross receipts exceed $25,000 OR did the organization's assets (market value) exceed

$25,000 at any time during this fiscal year? (Assets include land, buildings, funds, equipment, vehicles and other personal and real

property.)

Yes

No

C.

During the fiscal year, did the organization engage a fundraising professional in connection with fundraising activities in New York State?

These terms are defined at

Yes

No

If the answer to ANY of these questions is "Yes", please continue completing this form, beginning with Section 3.

If the answer to ALL of these questions is "No", please go directly to Section 8 of this form (Certification) to complete this form.

1

1 2

2 3

3 4

4 5

5 6

6 7

7