Employer'S Quarterly Return Of Tax Withheld Form - 2017

ADVERTISEMENT

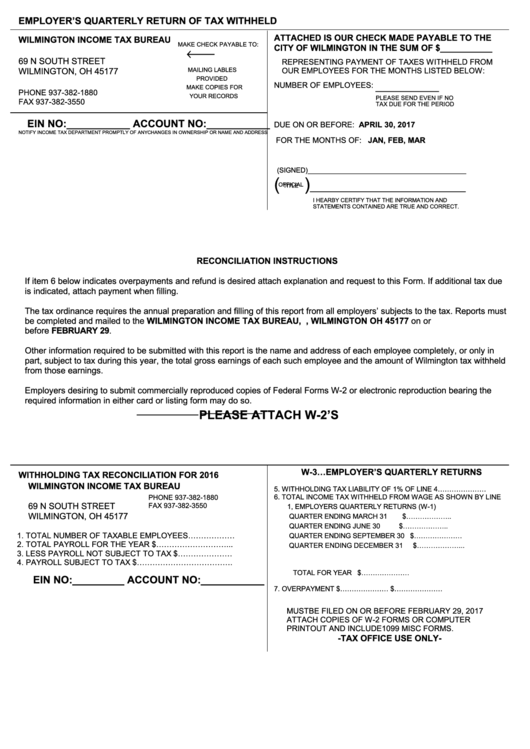

EMPLOYER’S QUARTERLY RETURN OF TAX WITHHELD

ATTACHED IS OUR CHECK MADE PAYABLE TO THE

WILMINGTON INCOME TAX BUREAU

MAKE CHECK PAYABLE TO:

CITY OF WILMINGTON IN THE SUM OF $___________

P.O. BOX 786

←

←⎯

69 N SOUTH STREET

REPRESENTING PAYMENT OF TAXES WITHHELD FROM

WILMINGTON, OH 45177

OUR EMPLOYEES FOR THE MONTHS LISTED BELOW:

MAILING LABLES

PROVIDED

___________

NUMBER OF EMPLOYEES:

MAKE COPIES FOR

PHONE 937-382-1880

YOUR RECORDS

PLEASE SEND EVEN IF NO

FAX 937-382-3550

TAX DUE FOR THE PERIOD

EIN NO:___________ ACCOUNT NO:___________

DUE ON OR BEFORE:

APRIL 30, 2017

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANYCHANGES IN OWNERSHIP OR NAME AND ADDRESS

FOR THE MONTHS OF: JAN, FEB, MAR

(SIGNED)_________________________________________

(

)

___________________________

OFFICIAL

TITLE

I HEARBY CERTIFY THAT THE INFORMATION AND

STATEMENTS CONTAINED ARE TRUE AND CORRECT.

W-1 EMPLOYER’S MONTHLY RETURN OF TAX WITHHELD

MILFORD INCOME TAX DEPT.

INCOME TAX DEPARTMENT

RECONCILIATION INSTRUCTIONS

P.O. BOX 632571

INCINNATI, OH 45263-2571

If item 6 below indicates overpayments and refund is desired attach explanation and request to this Form. If additional tax due

PHONE 513-248-5082

is indicated, attach payment when filling.

FAX 513-248-5099

The tax ordinance requires the annual preparation and filling of this report from all employers’ subjects to the tax. Reports must

be completed and mailed to the WILMINGTON INCOME TAX BUREAU, P.O. BOX 786, WILMINGTON OH 45177 on or

FILE NO:

before FEBRUARY 29.

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY

CHANGES IN OWNERSHIP OR NAME AND ADDRESS

Other information required to be submitted with this report is the name and address of each employee completely, or only in

part, subject to tax during this year, the total gross earnings of each such employee and the amount of Wilmington tax withheld

from those earnings.

Employers desiring to submit commercially reproduced copies of Federal Forms W-2 or electronic reproduction bearing the

required information in either card or listing form may do so.

I HEARBY CERTIFY THAT THE INFORMATION AND

STATEMENTS CONTAINED ARE TRUE AND CORRECT.

_____________

_____________

PLEASE ATTACH W-2’S

W-3…EMPLOYER’S QUARTERLY RETURNS

WITHHOLDING TAX RECONCILIATION FOR 2016

WILMINGTON INCOME TAX BUREAU

5. WITHHOLDING TAX LIABILITY OF 1% OF LINE 4…………………

P.O. BOX 786

6. TOTAL INCOME TAX WITHHELD FROM WAGE AS SHOWN BY LINE

PHONE 937-382-1880

69 N SOUTH STREET

FAX 937-382-3550

1, EMPLOYERS QUARTERLY RETURNS (W-1)

WILMINGTON, OH 45177

QUARTER ENDING MARCH 31

$………………..

QUARTER ENDING JUNE 30

$………………..

1. TOTAL NUMBER OF TAXABLE EMPLOYEES………………

QUARTER ENDING SEPTEMBER 30

$…………………

2. TOTAL PAYROLL FOR THE YEAR $………………………...

QUARTER ENDING DECEMBER 31

$………………...

3. LESS PAYROLL NOT SUBJECT TO TAX $…………………

4. PAYROLL SUBJECT TO TAX $……………………………….

TOTAL FOR YEAR

$…………………

EIN NO:_________ ACCOUNT NO:___________

7. OVERPAYMENT $…………………..OR TAX DUE $…………………

MUST BE FILED ON OR BEFORE FEBRUARY 29, 2017

ATTACH COPIES OF W-2 FORMS OR COMPUTER

PRINTOUT AND INCLUDE 1099 MISC FORMS.

-TAX OFFICE USE ONLY-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2