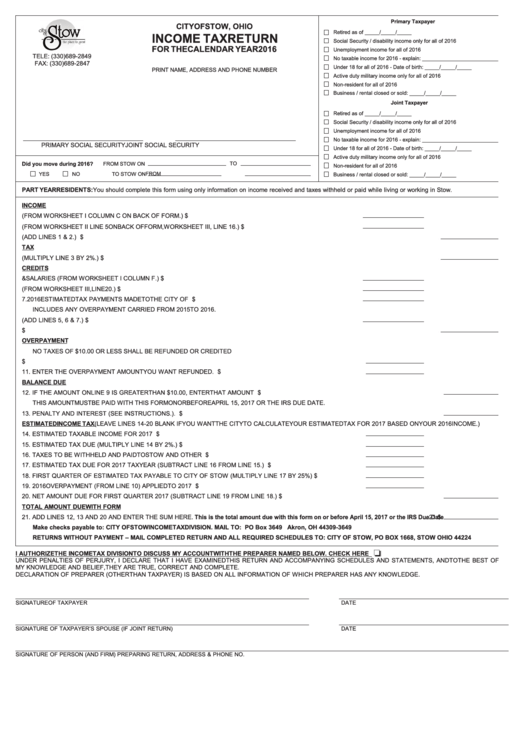

Income Tax Return Form - City Of Stow, Ohio

ADVERTISEMENT

Primary Taxpayer

CITY OF STOW, OHIO

Retired as of _____/_____/_____

INCOME TAX RETURN

Social Security / disability income only for all of 2016

FOR THE CALENDAR YEAR 2016

Unemployment income for all of 2016

TELE: (330) 689-2849

No taxable income for 2016 - explain: __________________________

FAX: (330) 689-2847

Under 18 for all of 2016 - Date of birth: _____/_____/_____

PRINT NAME, ADDRESS AND PHONE NUMBER

Active duty military income only for all of 2016

Non-resident for all of 2016

Business / rental closed or sold: _____/_____/_____

Joint Taxpayer

Retired as of _____/_____/_____

Social Security / disability income only for all of 2016

Unemployment income for all of 2016

No taxable income for 2016 - explain: __________________________

PRIMARY SOCIAL SECURITY

JOINT SOCIAL SECURITY

Under 18 for all of 2016 - Date of birth: _____/_____/_____

Active duty military income only for all of 2016

Did you move during 2016?

FROM STOW ON

TO

Non-resident for all of 2016

FROM

YES

NO

TO STOW ON

Business / rental closed or sold: _____/_____/_____

PART YEAR RESIDENTS: You should complete this form using only information on income received and taxes withheld or paid while living or working in Stow.

INCOME

1. GROSS WAGES AND SALARIES (FROM WORKSHEET I COLUMN C ON BACK OF FORM.)......................................1 $

2. NON-WAGE TAXABLE INCOME (FROM WORKSHEET II LINE 5 ON BACK OF FORM,WORKSHEET III, LINE 16.) . .... 2 $

3. TOTAL TAXABLE INCOME (ADD LINES 1 & 2.) ..............................................................................................................................................................3 $

TAX

4. STOW TAX DUE BEFORE CREDITS (MULTIPLY LINE 3 BY 2%.)..................................................................................................................................4 $

CREDITS

5. CREDIT FOR TAX WITHHELD ON WAGES & SALARIES (FROM WORKSHEET I COLUMN F.) . ..................................5 $

6. CREDIT FOR TAX PAID ON NON-WAGE INCOME (FROM WORKSHEET III,LINE 20.)................................................... 6 $

7. 2016 ESTIMATED TAX PAYMENTS MADE TO THE CITY OF STOW. ..............................................................................7 $

INCLUDES ANY OVERPAYMENT CARRIED FROM 2015 TO 2016.

8. TOTAL CREDITS (ADD LINES 5, 6 & 7.)............................................................................................................................8 $

9. SUBTRACT LINE 8 FROM LINE 4. ..................................................................................................................................................................................9 $

OVERPAYMENT

NO TAXES OF $10.00 OR LESS SHALL BE REFUNDED OR CREDITED

10. ENTER THE OVERPAYMENT AMOUNT YOU WANT APPLIED TO YOUR 2017 ESTIMATED TAX. ................................10 $

11. ENTER THE OVERPAYMENT AMOUNT YOU WANT REFUNDED. ..................................................................................11 $

BALANCE DUE

12. IF THE AMOUNT ON LINE 9 IS GREATER THAN $10.00, ENTER THAT AMOUNT HERE. THIS IS YOUR 2016 BALANCE DUE. .................... .........12 $

THIS AMOUNT MUST BE PAID WITH THIS FORM ON OR BEFORE APRIL 15, 2017 OR THE IRS DUE DATE.

13. PENALTY AND INTEREST (SEE INSTRUCTIONS.). ......................................................................................................................................................13 $

ESTIMATED INCOME TAX (LEAVE LINES 14-20 BLANK IF YOU WANT THE CITY TO CALCULATE YOUR ESTIMATED TAX FOR 2017 BASED ON YOUR 2016 INCOME.)

14. ESTIMATED TAXABLE INCOME FOR 2017 TAX YEAR.....................................................................................................14 $

15. ESTIMATED TAX DUE (MULTIPLY LINE 14 BY 2%.) ........................................................................................................15 $

16. TAXES TO BE WITHHELD AND PAID TO STOW AND OTHER MUNICIPALITIES. ..........................................................16 $

17. ESTIMATED TAX DUE FOR 2017 TAX YEAR (SUBTRACT LINE 16 FROM LINE 15.) ....................................................17 $

18. FIRST QUARTER OF ESTIMATED TAX PAYABLE TO CITY OF STOW (MULTIPLY LINE 17 BY 25%)............................18 $

19. 2016 OVERPAYMENT (FROM LINE 10) APPLIED TO 2017 ESTIMATED TAXES. ..........................................................19 $

20. NET AMOUNT DUE FOR FIRST QUARTER 2017 (SUBTRACT LINE 19 FROM LINE 18.) ..........................................................................................20 $

TOTAL AMOUNT DUE WITH FORM

21. ADD LINES 12, 13 AND 20 AND ENTER THE SUM HERE. This is the total amount due with this form on or before April 15, 2017 or the IRS Due Date...21 $

Make checks payable to: CITY OF STOW INCOME TAX DIVISION. MAIL TO: PO Box 3649 Akron, OH 44309-3649

RETURNS WITHOUT PAYMENT – MAIL COMPLETED RETURN AND ALL REQUIRED SCHEDULES TO: CITY OF STOW, PO BOX 1668, STOW OHIO 44224

I AUTHORIZE THE INCOME TAX DIVISION TO DISCUSS MY ACCOUNT WITH THE PREPARER NAMED BELOW. CHECK HERE

UNDE

R PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF

MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT AND COMPLETE.

DECLARATION OF PREPARER (OTHER THAN TAXPAYER) IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

SIGNATURE OF TAXPAYER

DATE

SIGNATURE OF TAXPAYER’S SPOUSE (IF JOINT RETURN)

DATE

SIGNATURE OF PERSON (AND FIRM) PREPARING RETURN, ADDRESS & PHONE NO.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2