Form Rl 53-08 - Instructions: Reinstatement Of Limited Partnership - 2013

ADVERTISEMENT

Contact:

Instructions:

RL

Kansas Office of the Secretary of State

Reinstatement of Limited

i

Memorial Hall, 1st Floor

(785) 296-4564

Partnership

53-08

120 S.W. 10th Avenue

kssos@sos.ks.gov

Topeka, KS 66612-1594

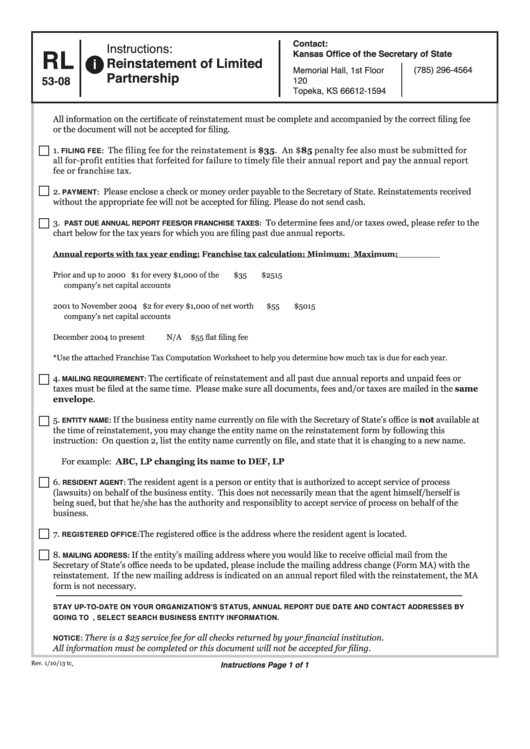

All information on the certificate of reinstatement must be complete and accompanied by the correct filing fee

or the document will not be accepted for filing.

1.

The filing fee for the reinstatement is $35. An $85 penalty fee also must be submitted for

FILING FEE:

all for-profit entities that forfeited for failure to timely file their annual report and pay the annual report

fee or franchise tax.

2.

Please enclose a check or money order payable to the Secretary of State. Reinstatements received

PAYMENT:

without the appropriate fee will not be accepted for filing. Please do not send cash.

3.

To determine fees and/or taxes owed, please refer to the

PAST DUE ANNUAL REPORT FEES/OR FRANCHISE TAXES:

chart below for the tax years for which you are filing past due annual reports.

Annual reports with tax year ending:

Franchise tax calculation:

Minimum:

Maximum:

Prior and up to 2000

$1 for every $1,000 of the

$35

$2515

company’s net capital accounts

2001 to November 2004

$2 for every $1,000 of net worth

$55

$5015

company’s net capital accounts

December 2004 to present

N/A

$55 flat filing fee

*Use the attached Franchise Tax Computation Worksheet to help you determine how much tax is due for each year.

4.

The certificate of reinstatement and all past due annual reports and unpaid fees or

MAILING REQUIREMENT:

taxes must be filed at the same time. Please make sure all documents, fees and/or taxes are mailed in the same

envelope.

5.

If the business entity name currently on file with the Secretary of State’s office is not available at

ENTITY NAME:

the time of reinstatement, you may change the entity name on the reinstatement form by following this

instruction: On question 2, list the entity name currently on file, and state that it is changing to a new name.

For example: ABC, LP changing its name to DEF, LP

6.

The resident agent is a person or entity that is authorized to accept service of process

RESIDENT AGENT:

(lawsuits) on behalf of the business entity. This does not necessarily mean that the agent himself/herself is

being sued, but that he/she has the authority and responsiblity to accept service of process on behalf of the

business.

7.

The registered office is the address where the resident agent is located.

REGISTERED OFFICE:

8.

If the entity’s mailing address where you would like to receive official mail from the

MAILING ADDRESS:

Secretary of State’s office needs to be updated, please include the mailing address change (Form MA) with the

reinstatement. If the new mailing address is indicated on an annual report filed with the reinstatement, the MA

form is not necessary.

STAY UP-TO-DATE ON YOUR ORGANIZATION’S STATUS, ANNUAL REPORT DUE DATE AND CONTACT ADDRESSES BY

GOING TO UNDER QUICK LINKS, SELECT SEARCH BUSINESS ENTITY INFORMATION.

There is a $25 service fee for all checks returned by your financial institution.

NOTICE:

All information must be completed or this document will not be accepted for filing.

Rev. 1/10/13 tc

Instructions Page 1 of 1

K.S.A. 56-1a606, K.S.A. 56-1a607

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2