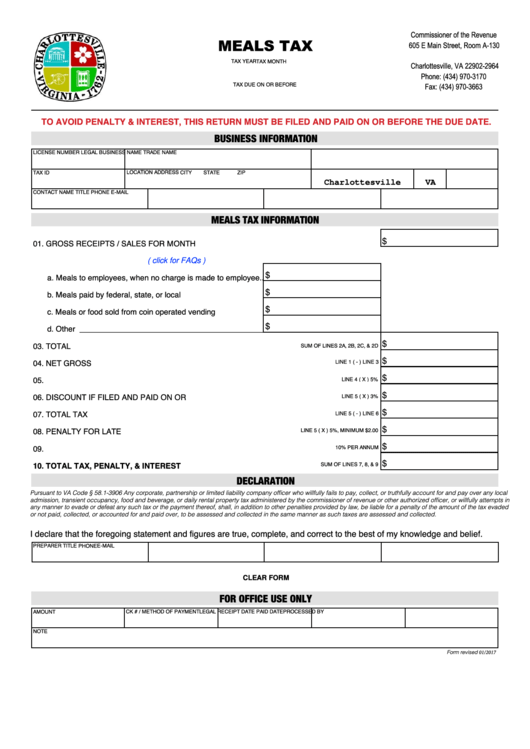

Commissioner of the Revenue

MEALS TAX

605 E Main Street, Room A-130

P.O. Box 2964

TAX YEAR

TAX MONTH

Charlottesville, VA 22902-2964

Phone: (434) 970-3170

TAX DUE ON OR BEFORE

Fax: (434) 970-3663

TO AVOID PENALTY & INTEREST, THIS RETURN MUST BE FILED AND PAID ON OR BEFORE THE DUE DATE.

BUSINESS INFORMATION

LICENSE NUMBER

LEGAL BUSINESS NAME

TRADE NAME

LOCATION ADDRESS

TAX ID

CITY

STATE

ZIP

Charlottesville

VA

CONTACT NAME

TITLE

PHONE

E-MAIL

MEALS TAX INFORMATION

$

01. GROSS RECEIPTS / SALES FOR MONTH ENDING.......................................................................

02. ALLOWABLE DEDUCTIONS

( click for FAQs )

$

a. Meals to employees, when no charge is made to employee..

$

b. Meals paid by federal, state, or local governments................

$

c. Meals or food sold from coin operated vending machines.....

$

d. Other __________________________________________

$

03. TOTAL DEDUCTIONS.......................................................................................................................

SUM OF LINES 2A, 2B, 2C, & 2D

$

04. NET GROSS RECEIPTS...................................................................................................................

LINE 1 ( - ) LINE 3

$

05. TAX....................................................................................................................................................

LINE 4 ( X ) 5%

$

06. DISCOUNT IF FILED AND PAID ON OR BEFORE...........................................................................

LINE 5 ( X ) 3%

$

07. TOTAL TAX DUE...............................................................................................................................

LINE 5 ( - ) LINE 6

$

08. PENALTY FOR LATE PAYMENT........................................................................................................

LINE 5 ( X ) 5%, MINIMUM $2.00

$

09. INTEREST..........................................................................................................................................

10% PER ANNUM

$

10. TOTAL TAX, PENALTY, & INTEREST..............................................................................................

SUM OF LINES 7, 8, & 9

DECLARATION

Pursuant to VA Code § 58.1-3906 Any corporate, partnership or limited liability company officer who willfully fails to pay, collect, or truthfully account for and pay over any local

admission, transient occupancy, food and beverage, or daily rental property tax administered by the commissioner of revenue or other authorized officer, or willfully attempts in

any manner to evade or defeat any such tax or the payment thereof, shall, in addition to other penalties provided by law, be liable for a penalty of the amount of the tax evaded

or not paid, collected, or accounted for and paid over, to be assessed and collected in the same manner as such taxes are assessed and collected.

I declare that the foregoing statement and figures are true, complete, and correct to the best of my knowledge and belief.

PREPARER

TITLE

PHONE

E-MAIL

CLEAR FORM

FOR OFFICE USE ONLY

AMOUNT

CK # / METHOD OF PAYMENT

LEGAL RECEIPT DATE

PAID DATE

PROCESSED BY

NOTE

Form revised 01/2017

1

1